Dubai property prices to get boost next year from foreign demand

BENGALURU, Dec 6 - Dubai house prices will extend their rise into next year at twice the rate expected three months ago, driven by demand from foreign investors and improving affordability, according to a Reuters poll of property analysts.

With a successful vaccination roll-out and an early easing of COVID-19 restrictions, Dubai's economy bounced back sharply this year as trade and travel sectors opened up, helping the previously ailing real estate sector.

Monthly data from the Dubai Land Department showed the city state's property sector had its best October in eight years, momentum which was expected to continue into 2022.

The Nov. 18-Dec. 6 Reuters poll of 11 property market analysts showed a median rise of 5.0% in Dubai house prices in 2022, twice the 2.5% forecast three months ago.

House prices were also expected to rise 5.0% in 2023.

"The success of Dubai's initial COVID-19 response, bolstered by the pace of the UAE's vaccine rollout, has positioned Dubai as the only major global city to remain largely restriction-free over 2021," said Chris Hobden, head of strategic consultancy at Chestertons MENA.

"The resulting stability, complemented by recent visa reforms, comparatively attractive pricing and the emirate's overall quality of life, has continued to draw new residents. With Dubai likely to see sustained economic improvements over 2022, we expect international demand to remain strong next year."

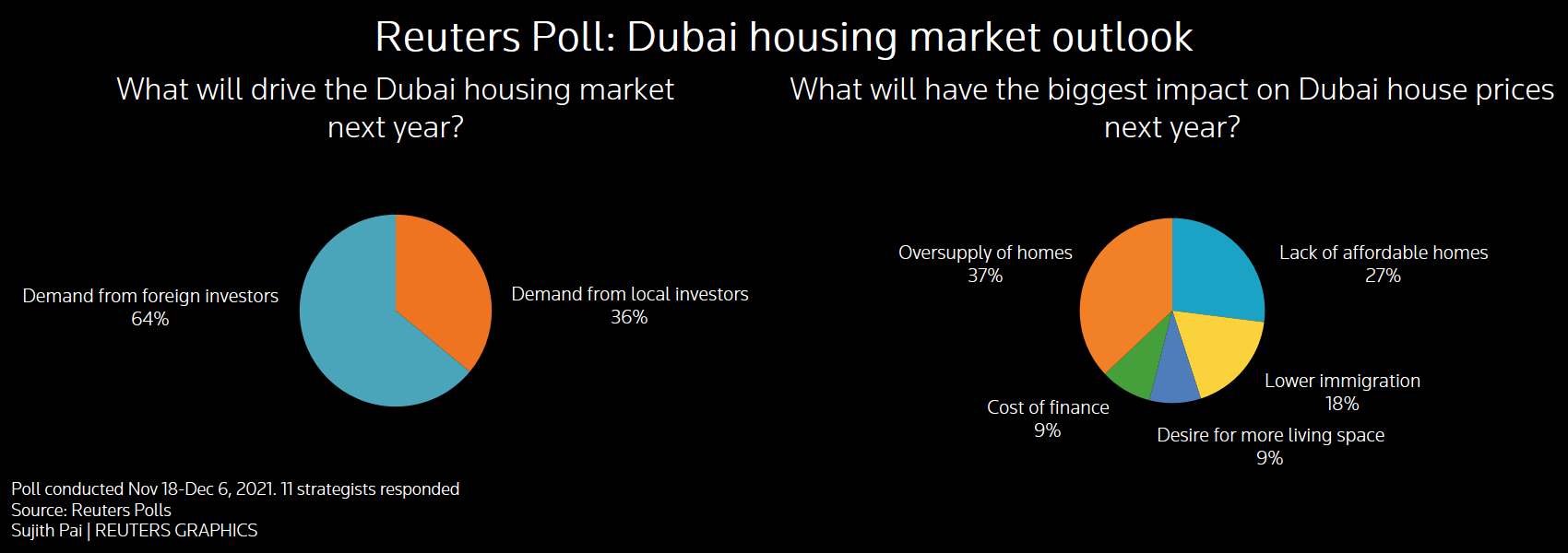

When asked what will drive Dubai's housing market next year, a majority of respondents, seven of 11, said demand from foreign investors. Four chose local demand.

An oversupply of homes from previous years has come to the rescue of this once hot property market by keeping affordability in check. Most other major property markets are struggling with runaway house price inflation.

Asked what will happen to housing affordability in the coming 2-3 years, six of 10 analysts said it would improve, while four said it would worsen.

"Given the rapid appreciation of property values and the decline in affordable and desirable inventory, a slowdown is likely to occur," said Zhann Jochinke, chief operating officer at Property Monitor.

"If prices continue to increase at the current rate we would see a 15%+ yearly gain which carries notable risk."

Source- www.reuters.com