The Dubai real estate sector saw $3.9bn of transactions last week, with two luxury apartments in Palm Jumeirah sold for $20m each

The Dubai real estate sector recorded more than AED14.3bn ($3.9bn) of transactions last week, according to data from the Land Department.

Sales dominated the figures, with AED9.47bn ($2.6bn), according to Land Department data.

In total there were 3,168 sales transactions recorded between July 1 and July 5.

Dubai real estate this week

Among the top listed sales transactions listed on the Land Department website were:

- An apartment in Orla Infinity by Omniyat, in Palm Jumeirah sold for AED77m ($20.9m)

- A second apartment in Orla Infinity by Omniyat, in Palm Jumeirah for AED75.8m ($20.6m)

- An apartment in Baccarat Residences, near the Burj Khalifa sold for AED43.5m ($11.8m)

The Land Department also showed mortgage deals worth AED3.87bn ($1.05bn) last week.

Gift transactions in the same period were valued at AED925m ($252m).

.webp)

THE number of homes worth US$10 million or more that were sold in Dubai held steady in the first half of the year despite a drop in listings, an industry report showed on Monday (Jul 8), as demand from the international ultra-rich stayed strong.

A total of 190 homes worth an overall US$3.2 billion were sold in the six months to the end of June compared with 189 properties for US$3.3 billion in the same period of 2023, according to provisional data from property consultancy Knight Frank.

The total number of deals held up despite a 65.5 per cent year-on-year drop in the number of such luxury homes available on the market in the second quarter, the report showed.

“This is a strong sign of the ‘buy-to-hold’ buyer profile that has taken root in the market,” Faisal Durrani, Knight Frank’s head of research for Middle East and North Africa, was quoted as saying in the report. The trend suggests international high-net-worth individuals “are largely focused on purchasing homes in the city for personal use, rather than to ‘flip’, which was a defining feature of the previous two market cycles”, he added.

Home to the world’s tallest tower, the United Arab Emirates’ Dubai is the Middle East’s biggest tourism and trade hub, attracting a record 17.2 million international overnight visitors last year. It is seeking to grow its economy through tourism, building a local financial centre and by attracting foreign capital, including into property, with property purchase and rental prices showing no signs of fizzling out.

The report showed palm tree-shaped artificial island Palm Jumeirah was the most sought-after area, recording 21 sales of homes worth US$10 million or more in the second quarter, accounting for 26 per cent of sales in the period. It was followed by Emirates Hills with 10 per cent and the District One area with 7.8 per cent of such deals.

Sales of properties worth US$25 million or more jumped 25 per cent in Q2 compared with the first three months of the year to a total of 15 homes.

Last year, Dubai ranked first globally for the number of home sales above US$10 million, selling nearly 80 per cent more such properties than second-placed London.

As the world strides into 2025, the Dubai real estate market remains a hub of growth and opportunity. The constant and innovative expansion of city are continually making it a magnet for investors and tourists as well. The property market in Dubai is expected to see a phenomenal rise in the remaining months of 2024 and an unprecedented boom in 2024. This trend of consistent growth is backed by several factors that ensures that the real estate market of Dubai remains unchecked for the future.

Is Dubai Real Estate Market Booming Year after Year?

The answer is off course yes! Dubai offers a plethora of investment opportunities both for investors and prospective home buyers. Several factors that help real estate in Dubai grow year after year are: Strategic location of the city, people-friendly tax policies, and diverse economy from all across the globe. According to Knight Frank, one of the leading global real estate consultants Dubai Ranks 16th among the world’s leading residential markets, that offers luxurious and premium properties at affordable prices.

Let us discuss in detail about the factors that helps real estate market in Dubai grow year after year:

- Tax- Friendly Environment

The main reason behind property market in Dubai becoming the magnet for investors is the tax-friendly environment of Dubai. It offers a unique advantage to investors, no particular income tax, no tax for capital gains, accompanied by no corporate tax. The tax-friendly environment of Dubai is a haven for expats and offers a fertile ground for financial growth, backed by a strong real estate market that develops in this supportive landscape.

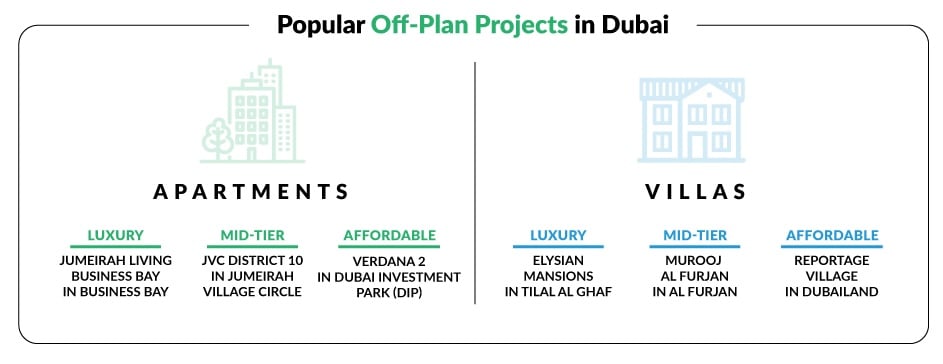

- State of the art Off-Plan Projects in Dubai

Top-notch off plan projects in Dubai are taking shape every day, giving rise to an extraordinary resident- friendly atmosphere. For example, Jumeirah Village Circle is popularly known for its high standard off plan property in Dubai and affordable flats, followed by Dubai Silicon Oasis and International City. As per the reports by several property experts apart from the JVC, Palm Jumeirah and other main neighbouring including Emirates Hills are gradually observing growth in selling properties.

- Developed Economy

Real Estate in Dubai is backed by a diversified economy. This golden city has strategically grown beyond expectation and its historical reliance on oil. Dubai is expanding in sectors like finance, tourism, technology, and trade. This positive expansion is leading Dubai towards a developed economy that is not dependent on just one sector.

- Top-Notch Developers

The reason behind several off plan projects in Dubai , taking place every day is that the UAE is a hub of world -class developers. The skyline properties in Dubai are synonymous with innovation and luxury, attributed to a group of top developers like Nakheel, EMAAR, Meraas, and Sobha to name a few.

- Connectivity across the Globe

Dubai is situated at the strategic location that has transformed it into a country with global connectivity, Dubai has world class ports and logistics infrastructure that support business activities in international trade routes. Entrepreneurs and investors view Dubai as a gateway to profit-making and expanded markets in the Middle East, Africa, and Asia.

Is it profitable to invest in Dubai Real Estate Market?

Dubai has carved a niche for itself and the trend continues in 2024 as well. It is a prime destination for real estate market and its related investment. Dynamic economy, supportive government, tax-free environment are some of the main reasons behind Dubai being a hotspot for expats. Adding more feathers to the cap of real sector market of Dubai is its high ROI yielding infrastructures and properties.

It is definitely a yes! When it comes to answering the question that is it profitable to invest in Dubai? Let us discuss some points in details to find more about this:

- Safe and Stable City

Dubai is a reputed city in terms of its safety and security. It has low crime rates and a secure environment; this city offers a safe haven for investments. The government of the UAE is supportive enough to implement various safety measures for foreigners that helps to invest safely. Dubai offers strict regulations, dedicated police force, and 24*7 surveillance systems.

- Strong Tourism Industry

Dubai’s rising population, no doubt has created a strong and robust demand for rental properties that includes apartments, villas, and commercial spaces. The high rental yields of city are highest among the world. The tourism industry is further contributing to the GDP of Dubai by creating a strong demand for short term rental properties.

- Best Return on Investment

Dubai Real Estate Market is well known for its highest ROI, with an average yearly return of 5% to 8.4 return, it competes strongly with other global cities and countries. The city’s growth in population and government initiatives is directly proportional to rising property prices and increased ROI for global investors.

- Freehold Ownership

Dubai has plethora of freehold areas. The prime reason behind investors moving towards Dubai is that Dubai freehold ownership allows non-UAE nationals to have their own properties and communities, with full ownership rights and ability to sell, lease, or occupy the property without any restrictions.

Top Off-Plan Projects in Dubai

Dubai is a hub of off-plan projects, with each and every project backed by robust economy, tax-free environment, and flexible payment options. Let us find out some of the top off plan projects in Dubai:

- Divine Living – Arjan Dubai

- Azizi Riviera Reve – Meydan City – Mohammed Bin Rashid City

- Six Senses Residences- Palm Jumeirah

- Murooj Al Furjan West – Al Furjan

Conclusion Dubai Real Estate Market waits for nobody, it is growing at a fast pace. Dubai is a beacon of opportunity and prosperity. As the city continues to grow and expand continuously, investing in Dubai Property Segment is a very good option, that gives high returns and enduring value. Looking forward, the growth is limitless in Dubai Market.

Most luxury home investors are delaying plans to sell in hopes of making bigger gains

Dubai: Is it getting harder to buy luxury homes in Dubai? Yes, but it’s not because of sky-high costs or because there is even a remote possibility of fewer buyers. In fact, as the ongoing demand for high-end properties from high-net-worth individuals consistently keep outpacing the supply of such homes in the Emirate, luxury home listings have been dropping, cites a recent survey.

The number of homes available for sale in Dubai’s prime residential markets – Emirates Hills, Jumeirah Bay Island, Jumeirah Islands and The Palm Jumeirah – has fallen by 47 per cent over the last 12 months to 2,851 properties, according to the latest analysis from global property consultant, Knight Frank.

Dubai's no-tax regime and golden visas attract record-high property transactions.

Dubai's real estate market is experiencing a surge among Chinese investors, following a 35% increase in quarter-on-quarter in transaction volumes, hitting an all-time high of 35,100 units, according to Savills. Notably 63% of these units are currently under construction.

“Dubai has been one of the standout economies for real estate investment over the past few years, particularly post-COVID,” said Andrew Cummings, Head of Residential, Middle East, at Savills. “We've seen tremendous capital growth, with over 17% capital growth last year alone.” .

Several key factors contribute to Dubai's allure. The city's tax-free regime offers significant financial advantages for investors. This fiscal environment, combined with the introduction of the 10-year golden visa for property investors with investments exceeding half a million dollars, has bolstered the market’s attractiveness.

The surge in transactions is also driven by Dubai’s ambitious population growth strategy. The government aims to double the population from just over 3 million to 6 million by 2040. This goal has led to a record influx of high-net-worth individuals, with over 4,500 millionaires relocating to Dubai last year alone.

“One of the things that’s propelled those are the visa reforms that have happened,” noted Cummings. The influx of new residents, many of whom are settling for the long term, has shifted the market dynamic from a transient to a more permanent population base.

Dubai's growth trajectory shows no signs of slowing down. The city’s GDP is forecasted to grow by over 4%, supported by substantial infrastructure investments like the $35 billion expansion of the new airport in the south of the city.

“Dubai's growth story is really only getting started,” Cummings said. Although the market may not see the same frenetic capital increases of recent years, steady growth of 6-7% is anticipated, reflecting a sustained positive outlook.

Dubai’s high rental yields, easy real estate financing, and accessible residency visas are factors driving property ownership over renting

As the first half of 2024 concludes, Dubai’s property market continues to exhibit robust growth, with a significant influx of foreign buyers, absorption of existing inventory, as well as movement into suburbs, according to data released by real estate firms.

Post-new year stability and rising prices

Following what looked like post-New Year stability in early Q1 2024, property prices in Dubai’s most searched-for areas have risen again, countering any speculations of a slowdown.

Despite the ongoing increase in property prices, Dubai remains highly affordable compared to other luxury real estate destinations worldwide, making it an attractive option for new and institutional investors, solidifying the city’s position as a global investment hub, as per Bayut’s latest report.

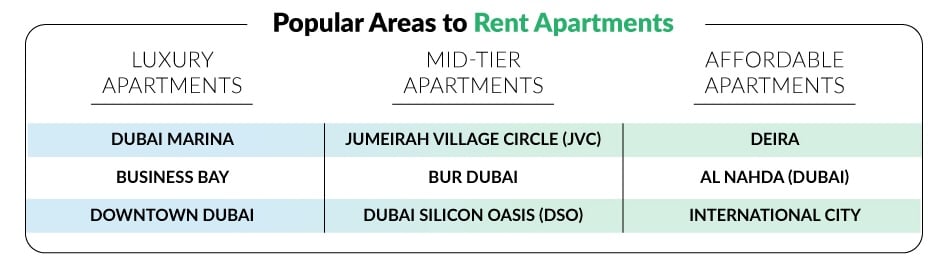

Its report on H1 trends shows that prospective homebuyers and investors for affordable properties have shown heightened interest in areas such as International City, Dubai South, DAMAC Hills 2, and The Valley by Emaar. Additionally, individuals looking for mid-range properties have gravitated towards neighbourhoods such as Jumeirah Village Circle, Jumeirah Lake Towers, Al Furjan, and The Springs.

Conversely, investors interested in luxury properties have focused on a range of options available in Dubai Marina, Business Bay, Arabian Ranches, and Dubai Hills Estate during H1 2024.

Record growth in sales volume

In the first half of 2024, Dubai’s property sector saw a year-on-year volume growth of more than 30 per cent, as reported by Property Monitor.

May 2024 marked a record-breaking month for sales transactions in Dubai.

Property Monitor reported a 47.7 per cent month-on-month increase and a 45.9 per cent year-on-year rise in sales transaction volumes. Similarly, haus & haus also noted that May was their best performing month, possibly due to delayed transactions from April caused by unprecedented storms and flooding in Dubai.

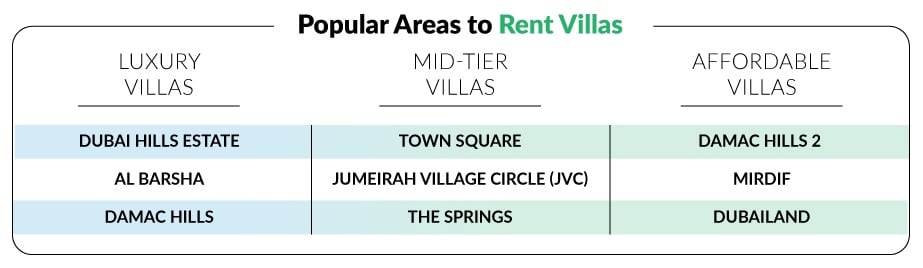

Rising demand for villas

The demand for villas continues to surge as Dubai’s population grows and matures. Property Monitor’s H1 figures indicate significant volume growth for villas, driven by residents looking for family-friendly, long-term living options.

In response, developers have launched 3,323 villas in H1, with many expected to be completed by 2028.

Emaar has announced key master community projects such as The Oasis, The Heights Country Club and Wellness, and Grand Polo Club & Resort, which have garnered strong interest from investors.

High demand for new real estate projects

More than 80 per cent of new property units launched in Dubai since 2022 have sold out, highlighting the high demand for off-plan projects.

Dubai Land Department data shows nearly 214 projects launched, with 148 currently active.

Taimur Khan, head of research for CBRE in the Middle East, noted that despite concerns about an oversupply dampening prices, new stock absorption remains high, with at least 70 per cent of units launched since 2022, sold to date.

Trends for buying properties in Dubai

Meanwhile, Bayut’s data indicates that sales prices for apartments and villas in prominent Dubai neighbourhoods have recorded significant increases, with the highest increase reaching up to 17 per cent for villas in The Valley by Emaar, during the first half of 2024.

In the mid-tier property segment, there has been a noticeable increase in average sales transaction prices for apartments, varying from 12 per cent to 40 per cent, with the most significant growth observed in Jumeirah Lake Towers.

Similarly, sought-after areas featuring mid-tier villas have observed increases in average transaction sales prices ranging from 4 per cent to 23 per cent. Most areas in the luxury property segment have consistently recorded increases in transactional prices, ranging from 5 per cent to 24 per cent.

Record transaction volumes

According to data from Bayut’s Dubai transactions, which leverages data from the DLD, the first half of 2024 saw a total of 43,075 property sale transactions. These transactions amounted to a combined value of Dhs122.9bn, covering both residential and commercial properties.

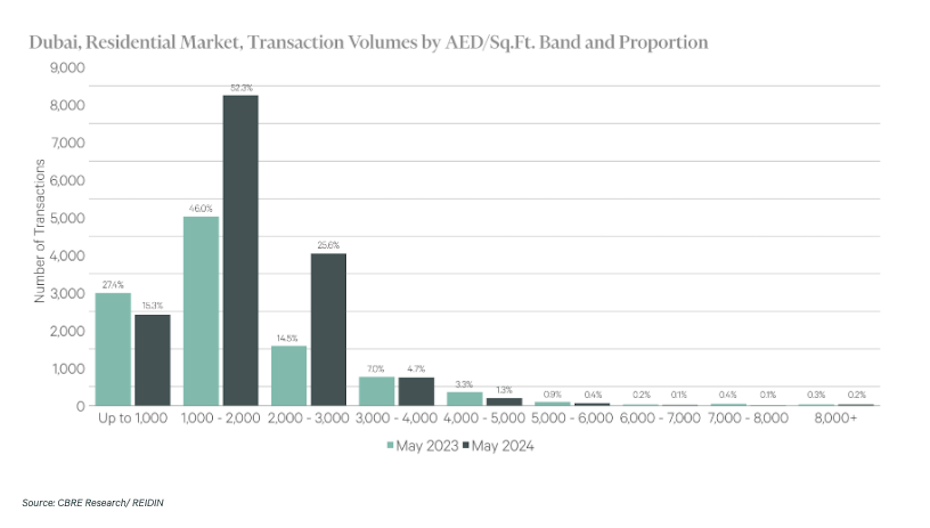

Shifts in price brackets

According to CBRE, there has been a notable shift in market dynamics. The sales numbers in the first half of 2024 have been marked by a shift in transaction price brackets.

Transactions below Dhs1,000 per square foot declined by 19.3 per cent in May 2024 compared to the previous year.

However, transactions in the Dhs1,000 to Dhs2,000 per square foot range grew by 64.1 per cent. The Dhs2,000 to Dhs3,000 per square foot bracket saw a significant increase of 154 per cent in activity.

The higher-end segment, priced between Dhs3,000 and Dhs8,000 per square foot, experienced a 19.5 per cent drop in activity due to limited stock availability. Properties priced above Dhs8,000 per square foot accounted for just 0.2 per cent of total sales in May 2024, as per CBRE data.

Changing buyer preferences

Taimur Khan, head of research for CBRE in the Middle East, noted that despite concerns about an oversupply dampening prices, new stock absorption remains high, with at least 70 per cent of units launched since 2022 sold to date.

Sales transactions have moved away from Dubai’s core and prime residential hubs, with buyers now exploring other areas.

Tatiana El Bazi, senior research analyst at CBRE, noted that recent data indicates a trend of buyers shifting away from the city’s central and prime areas.

Trends for renting properties in Dubai

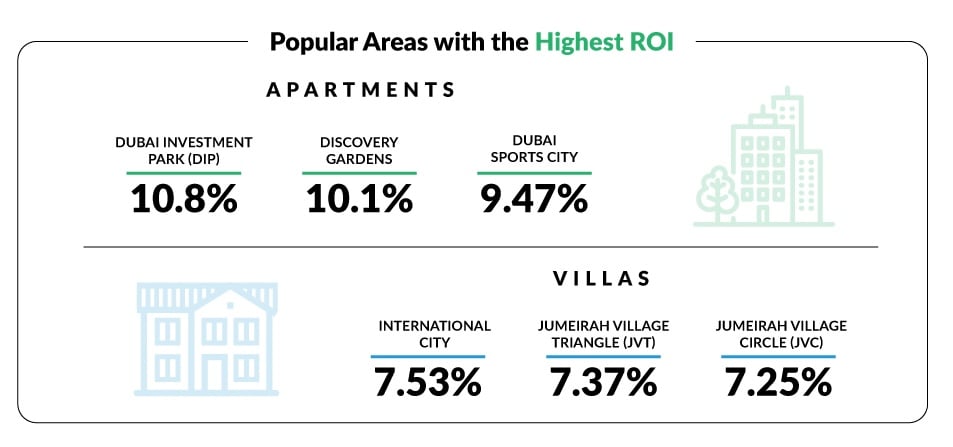

In terms of ROI based on projected rental yields for apartments, areas such as Dubai Investments Park (DIP), and Discovery Gardens, have emerged as top choices for potential investors seeking affordable properties, offering yields of up to 11 per cent.

For mid-tier apartments, Dubai Sports City, Dubai Silicon Oasis, and Motor City are particularly attractive, with rental yields surpassing 9 per cent.

Additionally, luxury apartment locations such as Green Community, Al Sufouh, and DAMAC Hills have shown impressive returns of up to 9 per cent, outpacing many global real estate markets.

Bayut’s analysis of ROI trends for villa communities also shows a positive outlook. Buy-to-let villas in International City offer an average ROI exceeding 7 per cent, making them attractive for investors.

Areas such as DAMAC Hills 2 and Wasl Gate provide ROI percentages above 6 per cent.

Mid-tier villas in Jumeirah Village Triangle, Jumeirah Village Circle, and Mudon have projected ROIs ranging from 6 per cent to 8 per cent.

In the luxury villa market, The Sustainable City stands out with an ROI exceeding 7 per cent, due to the unique features of the properties and limited market supply. Additionally, communities like Tilal Al Ghaf and Al Barari, which cater to family needs, present strong ROIs of over 6 per cent.

Bayut said its data analysis indicates notable increases in advertised rental prices across various segments in popular areas.

Affordable apartment rentals have seen surges ranging from 4 per cent to 31 per cent, with studio flats in Al Nahda reporting the most significant price hike. Mid-tier apartments have experienced upticks of up to 15 per cent. Luxury apartment rentals have generally increased by up to 7 per cent, although some units in Business Bay and Downtown Dubai reported price decreases of under 6 per cent.

Budget villa rentals have gone up by as much as 12 per cent. Mid-tier villa rentals have increased by up to 15 per cent, with certain bed types in Town Square seeing price decreases of under 1 per cent. Luxury villa rentals have surged by up to 27 per cent, with DAMAC Hills recording the highest increase for its limited inventory of 6-bed units.

For those seeking affordable accommodation, Deira and Al Nahda have become popular choices for apartments, while DAMAC Hills 2 and Mirdif have attracted interest for villas.

In the mid-tier segment, Jumeirah Village Circle (JVC) and Bur Dubai apartments have remained in high demand among tenants, whereas properties in Town Square and JVC have appealed to those in search of villas.

In the luxury category, Dubai Marina and Business Bay have maintained their popularity for apartment rentals, while Dubai Hills Estate and Al Barsha have been the desired destinations for high-end villa rentals.

Increase in rental prices

Transactional rental prices in affordable neighbourhoods for both villas and apartments have generally increased by 2 per cent to 9 per cent. Mid-tier segment apartment and villa rentals have reported increases of up to 10 per cent.

In the luxury real estate segment, transactional prices for both apartment and villa rentals have also risen by up to 10 per cent.

Commenting on the findings, Haider Ali Khan, CEO of Bayut and head of Dubizzle Group MENA said, “Amidst the global economic slowdown and rising interest rates, we have noticed a pattern of investors worldwide turning to wealth-preserving assets.

“Dubai’s real estate sector has emerged as a standout choice in today’s economic climate, with prices and consumer interest continuing to rise even after a 24-month period of continuous growth.”

Who is buying in Dubai?

As evident from the data, there has been a notable surge in demand for both apartments and villas, accompanied by significant increases in transaction prices and volumes.

This rising trend in property prices reflects a dynamic market sentiment. Dubai’s high rental yields, easy real estate financing, and accessible residency visas are factors driving property ownership over renting.

A report by W Capital revealed that British investors were the top purchasers in Dubai’s real estate market during the first half of 2024. Other prominent nationalities included Indians, Chinese, Lebanese, Canadians, French, Italians, Dutch, Pakistanis, and Turkish buyers.

The report showed palm tree-shaped artificial island Palm Jumeirah was the most sought-after area

The number of homes worth $10 million or more that were sold in Dubai held steady in the first half of the year despite a drop in listings, an industry report has shown.

A total of 190 homes worth an overall $3.2 billion were sold in the six months to end June compared with 189 properties for $3.3 billion in the same period of 2023, according to provisional data from property consultancy Knight Frank.

The report provides evidence that demand from the international ultra-rich stayed strong.

The total number of deals held up despite a 65.5% year-on-year drop in the number of such luxury homes available on the market in the second quarter, the report showed.

“This is a strong sign of the ‘buy-to-hold’ buyer profile that has taken root in the market,” Faisal Durrani, Knight Frank’s head of research for Middle East and North Africa (MENA), was quoted as saying in the report.

The trend suggests international high-net worth individuals “are largely focused on purchasing homes in the city for personal use, rather than to ‘flip’, which was a defining feature of the previous two market cycles,” he added.

Home to the world’s tallest tower, the United Arab Emirates’ Dubai is the Middle East’s biggest tourism and trade hub, attracting a record 17.15 million international overnight visitors last year.

The city-state was quick to reopen after the pandemic. That, together with massive infrastructure spending, generous income tax policies and relaxed social and visa rules, lured thousands of foreigners, including Russians amid war in Ukraine.

Under a 10-year plan known as D33, Dubai is seeking to grow its economy by investing in tourism, turning its local financial centre into one of the top four globally and by attracting foreign capital, including into real estate, with property purchase and rental prices showing no signs of fizzling out.

It is also becoming a preferred wealth hub for many entrepreneurs and rich families in Asia, launching a “family wealth centre” last year to help wealthy individuals and businesses deal with cultural issues and governance.

The Knight Frank report showed palm tree-shaped artificial island Palm Jumeirah was the most sought-after area, recording 21 sales of homes worth $10 million or more in the second quarter, accounting for 26% of sales in the period.

It was followed by Emirates Hills with 10% and the District One area with 7.8% of such deals.

Sales of properties worth $25 million or more jumped 25% in the second quarter compared with the first three months of the year to a total of 15 homes.

Last year Dubai ranked first globally for the number of home sales above $10 million, selling nearly 80% more such properties than second-placed London

Dubai property sales transactions in May rose 47 percent from April

The areas with the biggest rises in villa purchases were Haven (pictured), Tilal Al Ghaf, Dubai South, Reportage Village and MBR City

The property market in Dubai witnessed substantial growth in residential transactions during May 2024 compared to the previous month.

According to new figures released, transactions for off-plan villas increased sharply by 209 percent in May versus April.

For all the latest business news from the UAE and Gulf countries, follow us on Twitter and LinkedIn, like us on Facebook and subscribe to our Youtube page, which is updated daily.

Whether off plan or ready property, there is a gradual shift in pricing dynamic

In red-hot real estate markets, it becomes hard to value properties as many factors come into the equation: location, size, layouts, proximity to the sea, renovations, in addition to comparable launches taking place at hyperkinetic speeds.

Typically, during this time, there are a number of buyers who go for older properties, as the gap rises between prices of older and newer builds. Built into this decision is the factor that there are a number of renovations needed for older builds.

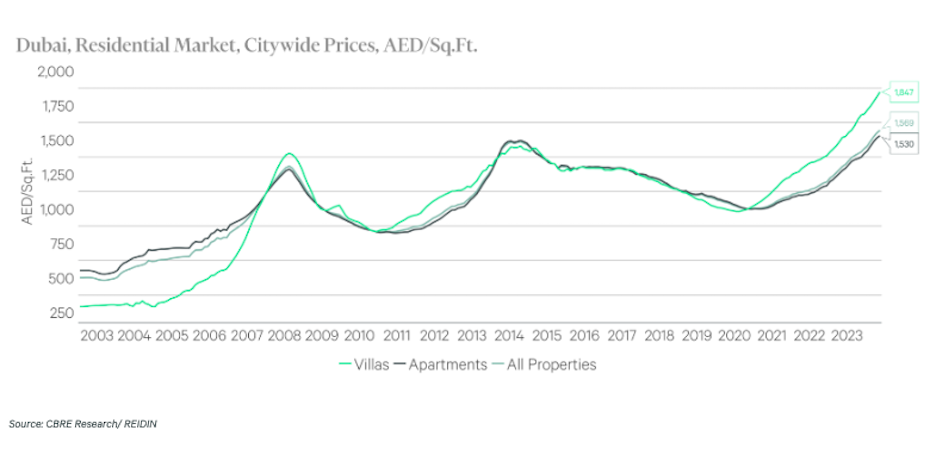

Market analysts predict a banner year for Dubai's residential property market in 2024, with villa prices poised for exceptional capital gains

Dubai’s residential property market is forecast to scale new heights in 2024, with analysts predicting record-breaking home prices. This growth is expected to be particularly pronounced in the villa segment, which is projected to witness significant capital gains.

According to ValuStrat’s April Price Index (VPI) for Dubai, apartment prices are steadily rising, although at a more moderate pace than villas. Villas were the standout performers, with the average valuation per square foot surpassing AED 2,000 for the first time in a decade. This milestone marks a doubling of villa prices since the pandemic, surpassing previous market peaks and even 2014 highs.

Capital gains in the villa segment are also expected to continue. While not quite surpassing the record set in 2022, which saw a 34. 1% price increase – the highest in a decade–analysts predict gains exceeding that mark. The April VPI data bolsters this prediction, revealing a 2.4% month-on-month rise and a staggering 31. 2% year-on-year increase in villa capital gains.

The strong performance of the Dubai real estate market can be attributed to the increase in high-net-worth individuals moving to the city, supported by government initiatives and a growing business environment. This has led to a higher demand for luxury properties, which impacts the overall market trends. Additionally, low interest rates are expected to continue, making borrowing costs favourable and encouraging more investors to enter the real estate market.

The VPI reached 170.8 points in April, marking a 26.1% annual increase, with a monthly rise of 2%. Villas reached 216 points, while apartments stood at 141.4 points, compared to the baseline of 100 points set in January 2021.

Apartment prices rose by 1.6%, marking a record annual growth of 21.3%. Among the areas with the highest apartment capital gains compared to the previous year are Discovery Gardens (33.4%), The Greens (31.4%), Palm Jumeirah (29.9%), The Views (27.1%), and Al Quoz.

Villa capital gains were at 2.4% compared to March and 31.2% since the previous year. Notably, top annual performers were villas in highly sought-after areas like Palm Jumeirah (40.1%), Jumeirah Islands (39.5%), Dubai Hills Estate (36.2%), Green Community West (31.4%), and Emirates Hills (31.1%).

Off-plan Oqood registrations saw a significant increase of 76.4% annually but experienced a monthly decline of 9.4%. Ready home transactions also rose by 9.5% since last year, although they dropped by 24.2% since March, making up only 30% of monthly residential unit sales. Notably, there were 27 transactions for ready properties priced over AED 30 million, with prime locations including Palm Jumeirah, Arabian Ranches, Jumeirah Bay Island, Emirates Hills, and Downtown Dubai.

Dubai’s property market is thriving, in line with the emirate’s economic objectives. The government is working to strengthen Dubai’s status as a global business and tourism hub, and a successful real estate sector is essential for attracting foreign investment and skilled individuals. As Dubai advances, the focus remains on the residential property market, with experts forecasting continued growth until 2024.