Expo 2020 is having a positive impact on Dubai property sales, with transaction volumes reaching close to $5 billion in November, making it the best month in almost eight years, the Dubai Land Department (DLD) said on Thursday.

“It has been over 70 days since Expo2020 started, and the greatest show in the world may have had ripple effects on the Dubai real estate market as November 2021 showed the highest monthly sales figures in eight years,” the government agency said in a statement.

It said November 2021 had 6,989 sales transactions worth 17.95 billion dirhams ($4.89 billion), making it the best November on record since Jan 2014.

Total sales transactions were up 58.79 percent on the same month in 2020, and values up 88.37 percent, the department said.

More than half of the transactions, 54 percent, were in the secondary or ready property market, with the remaining 46 percent off-plan.

The Land Department said their data showed that Expo 2020 Dubai has a positive effect on Dubai’s real estate market movement.

“This activity was directly reflected in the market's performance, where an upward trend is observed and is likely to continue in the coming year.”

DLD’s 21st edition of Mo’asher, the emirate’s sales price index, which has a base month of January 2012 and a base quarter of Q1 2012, was 1.156 for November 2021, with an index price of 1,115,937 dirhams.

The index is the highest since March 2019.

Transactions for the year to date, including November, have reached a total of 55,640, worth 135.4 billion dirhams, already the highest yearly sales figure since 2014.

Month-on-month, from October to November, total sales transaction value increased by 36.82 percent and volume increased by 30.59 percent.

“Comparing overall performance for the month compared to November 2020, November 2021 had 80.1 percent more sales transactions that were valued at 138.7 percent more.”

“For a more realistic comparison, when we compare it to November 2019, November 2021 had 45.2 percent more sales transactions, which were 104.1 percent more in value,” the statement concluded.

Source- www.zawya.com

The Realty sector in Dubai is back in the limelight beating the Covid-induced uncertainties and it is showing strong signs of sustained growth if one is to go by the statistics released by the Dubai Land Department (DLD) last week. According to DLD, Dubai has recorded the best October in the past 8 years as the real estate sector attracted a whopping Dh.13.12 billion in investments spread over 5,352 deals.

The year-to-date total sales reached 48,651 valuing Dh.177.44 billion. This is a 38.34% year-on-year growth in terms of transactions and 63.4% in terms of value during the first 10 months of the current year,” DLD authorities revealed. The sector’s recovery is most evident in the villa segment commanding better prices compared to October last year.

Independent analysts and industry experts concurring with the DLD authorities observe that a number of factors including a slew and economic reforms, successful vaccination drive coupled with ongoing Expo 2020 have helped Dubai’s economy to bounce back sharply from the pandemic which in turn is reflecting in the realty sector’s growth.

“There is no doubt that Dubai’s real estate sector has bounced back and from the market trend we can be reasonably sure that the sector is on a sustainable growth path at least for the next three years. This is the best time to invest in Dubai property considering the fact that the value will steadily appreciate by 2023-24,” said Shilpa DK, CEO of Arqonz.com.Arqonz is a Chennai-based e-commerce platform that is dedicated exclusively for the real estate and construction industry. The company is also a major exporter of construction materials and other products like natural stones, outdoor and wicker furniture. Shilpa says that Arqonz has clearly benefited from the current growth phase of Dubai’s real estate sector.

“We are getting more enquiries and our export volume has gone up sharply during the last 4-5 months. If the current trend is any indication, I can say busy days are back,” she said. Expo 2020 is not only the only reason that has helped the recovery of the sector, she added. A host of reforms including 100% ownership law and the 2040 Master Plan are also reasons, according to her.

That Dubai now has a favourable climate for investment in properties gets further endorsed by leading real estate players who are planning new projects. Danube Group, for instance, is one among them. “Business is coming back to pre-Covid normalcy,” said Danube Group managing director Adel Sajan, adding: “We are preparing to launch a number of new initiatives to support economic growth.”

Source- economictimes.indiatimes.com

BENGALURU, Dec 6 - Dubai house prices will extend their rise into next year at twice the rate expected three months ago, driven by demand from foreign investors and improving affordability, according to a Reuters poll of property analysts.

With a successful vaccination roll-out and an early easing of COVID-19 restrictions, Dubai's economy bounced back sharply this year as trade and travel sectors opened up, helping the previously ailing real estate sector.

Monthly data from the Dubai Land Department showed the city state's property sector had its best October in eight years, momentum which was expected to continue into 2022.

The Nov. 18-Dec. 6 Reuters poll of 11 property market analysts showed a median rise of 5.0% in Dubai house prices in 2022, twice the 2.5% forecast three months ago.

House prices were also expected to rise 5.0% in 2023.

"The success of Dubai's initial COVID-19 response, bolstered by the pace of the UAE's vaccine rollout, has positioned Dubai as the only major global city to remain largely restriction-free over 2021," said Chris Hobden, head of strategic consultancy at Chestertons MENA.

"The resulting stability, complemented by recent visa reforms, comparatively attractive pricing and the emirate's overall quality of life, has continued to draw new residents. With Dubai likely to see sustained economic improvements over 2022, we expect international demand to remain strong next year."

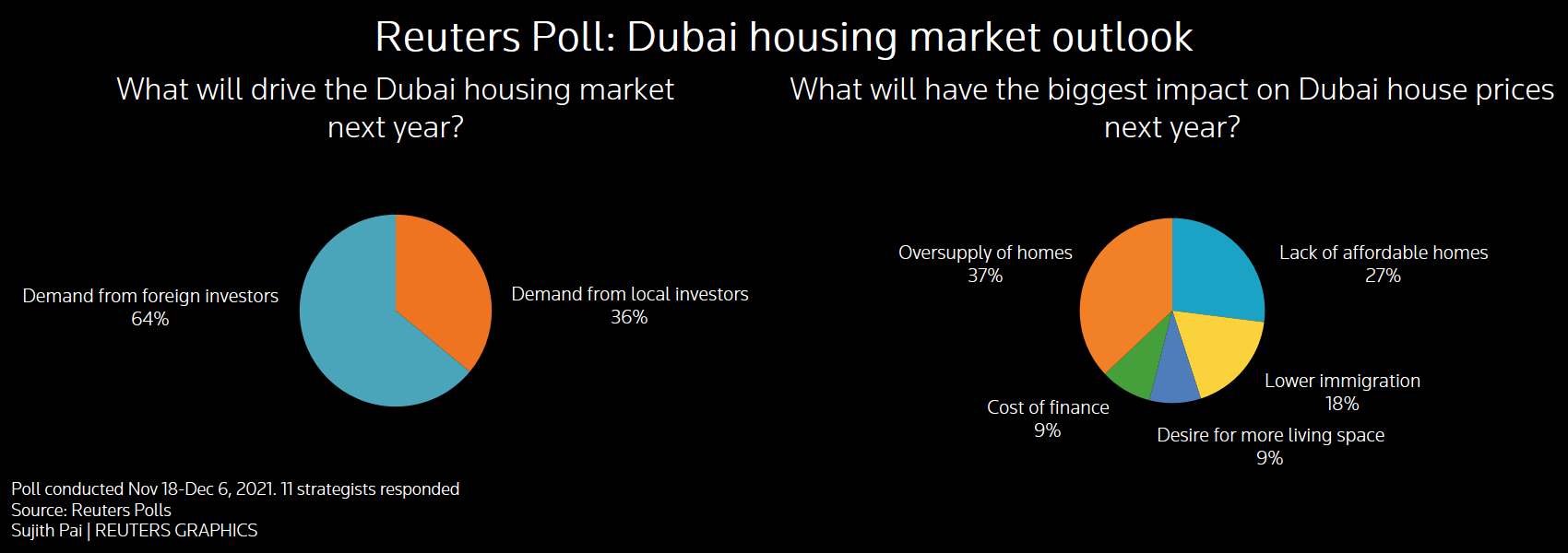

When asked what will drive Dubai's housing market next year, a majority of respondents, seven of 11, said demand from foreign investors. Four chose local demand.

An oversupply of homes from previous years has come to the rescue of this once hot property market by keeping affordability in check. Most other major property markets are struggling with runaway house price inflation.

Asked what will happen to housing affordability in the coming 2-3 years, six of 10 analysts said it would improve, while four said it would worsen.

"Given the rapid appreciation of property values and the decline in affordable and desirable inventory, a slowdown is likely to occur," said Zhann Jochinke, chief operating officer at Property Monitor.

"If prices continue to increase at the current rate we would see a 15%+ yearly gain which carries notable risk."

Source- www.reuters.com

by Muzaffar Rizvi

Published: Tue 7 Dec 2021, 10:39 AM

Last updated: Tue 7 Dec 2021, 8:29 PM

Dubai's prime areas have enrolled a strong growth in the past two years as investors and end-users preferred to invest in properties offering more space and facilities to enjoy a better lifestyle in the post-pandemic era, the latest data shows.

Advertisement

Paid Content

speakol

UAE: What’s The Best Way To Profit From Small Investment?

speakolInvestment Guru

Real estate consultancy ValuStrat Price Index indicated that villas and apartments in Dubai's prime locations such as Palm Jumeirah, Arabian Ranches, Jumeirah Beach Residences, The Lakes, and Emirates Hills registered double-digit growth in price appreciation and transactions in November.

ADVERTISING

The villa segment in Arabian Ranches posted a year-on-year 34.1 per cent increase in property values and 58.9 per cent growth in transactions. The Lakes villas registered 31.2 per cent price appreciation with a 16 per cent rise in sales deals, according to ValuStrat Price Index.

For apartments, Palm Jumeirah recorded 17.3 per cent year-on-year price gains with a 131.1 per cent increase in transactions last month. Jumeirah Beach Residences apartments also posted 14.6 per cent growth in capital values with 68.1 per cent more sales transactions in November.

Prime locations will continue to grow

Haider Tuaima, head of Real Estate Research at ValuStrat, said residential prime locations in Dubai are in demand and their prices will continue to appreciate at a steady pace next year after staging strong growth in 2021.

ALSO READ:

Advertisement

Dubai: Penthouse sold for Dh40 million at Jumeirah Bay Island

Dubai property transactions hit 8-year highs for second time in November

Dubai property sales nearly double since beginning of Expo 2020

“For 2022, we expect capital values of residential prime areas will continue their upward trend, but at lower growth rates averaging five per cent to 10 per cent," Tuaima told Khaleej Times on Tuesday.

"When it comes to capital gains in residential prime locations, the ValuStrat Price Index clearly shows that villas are performing much better than apartments. Villa prices are already at pre-pandemic levels, while apartments still have some way to go," he said.

"Transaction deal sizes increased at triple digits in some areas, even when compared to 2019, due to two main reasons. Capital values increased, but more importantly, people are buying bigger homes," he added.

Elaborating, he said average unit size increased considerably in the past two years as buyers want more space in their homes.

"In 2019, the average size of a residential unit sold was 1,524 square feet, and that figure increased to 1,905 square feet in 2020 and further climbed to 2,057 square feet,” he added.

Modern infrastructure, affordable rates

Zoom Property Insights said Dubai prime areas remained in demand because of their strategic locations, modern infrastructure and affordable rates.

The latest data compiled by the property portal showed that Dubai Marina, Business Bay and Jumeirah Village Circle are among the best areas to buy a residential unit in Dubai while Palm Jumeirah, Downtown Dubai and Arabian Ranches are equally popular in the luxury category.

Ata Shobeiry, CEO at Zoom Property, said that property buyers with limited budgets are mostly preferring suburban districts with affordable housing. However, areas closer to the Expo 2020 site have picked up the ace as well.

“The demand for properties has also increased in more established areas renowned for offering upscale lifestyle,” Shobeiry said.

ALSO READ:

UAE: New residential property supply slows significantly

Dubai, Abu Dhabi house prices soar at fastest pace since 2015

Dubai realty bets on sustainable recovery

Substantial growth in 2021

The Dubai property market witnessed substantial growth in 2021 after a brief setback in 2020 due to the global pandemic. The V-shaped recovery is evident as the demand and prices of properties in various areas are on the rise.

On the whole, the residential property prices witnessed a jump of 21 per cent during the first 10 months of the year, according to Zoom Property Insights.

“The fourth quarter is also expected to end on a high note as there is increased activity in the property market,” it added.

Double-digit returns

Farhad Azizi, CEO of Azizi Developments said the Palm Jumeirah has always been a sanctum for property investors, with promised double-digit returns in many cases.

"Dubai has seen a hike in transactional activity, with 16,019 units sold in the third quarter of 2021 alone, double the figures since the third quarter of 2020. Not only that, but the average apartment deal size in Palm Jumeirah has risen to about Dh2,327 per square feet, the highest since 2016,” Azizi told Khaleej Times on Tuesday.

"Due to the sophisticated, opulent, and contemporary lifestyle that it provides, our project, Mina, is in great demand from both local and foreign investors. Europeans have been investing in Dubai for holiday home purposes in the consolidation of this demand, which is a reflection of our dedication to our customers, careful attention to detail, and contributions to the development of the UAE's breathtaking scenery,” he said.

He said Mina unit prices start at Dh2,000 per square foot, ranging in total value from Dh2.6 million for one-bedroom apartments to Dh26.8 million for a lavish penthouse with a private pool.

"Over 96 per cent of this development is already sold out to more than 41 nationalities, with the remaining stock not having been released to the market yet," he added.

Source- www.khaleejtimes.com

Buyers have snapped up thousands of homes in Dubai since the start of Expo 2020, bringing the year-to-date real estate deals to 135.4 billion dirhams ($36.8 billion), up by 88.39 percent from last year and the highest since 2014, Property Finder reported on Monday.

From October to November, a total of 12,352 properties with a combined value of 31.08 billion dirhams went to buyers. The transacted properties included 7,000 secondary or ready residential units worth 19.84 billion and 5,352 off-plan units worth 11.24 billion dirhams.

The month of November alone saw 7,000 deals valued at 17.96 billion dirhams, making it the best month on record since Expo 2020 was announced in December 2013, according to Property Finder.

“The question on everyone’s mind is are we starting to see the effects of Expo 2020 in the real estate market and the trends are giving us the answers,” said Lynnette Sacchetto, Director of Research and Data at Property Finder.

“It is also interesting to note that 2021 to date had the highest off-plan value since 2009 which was the peak for off-plan sales in Dubai. The data clearly shows that investors and consumers are confident in Dubai’s future which is reinforced by proactive government initiatives, attractive real estate projects and the vision of the city.”

Expo 2020 Dubai

Expo 2020 Dubai logged a total of 2.35 million visits during the first month of the world’s fair, according to organisers. However, it is not clear how many people had visited the global event, with most Expo 2020 pass holders making more than one visit to the site.

In its report, Property Finder said more than half (54 percent) of all transactions during the first month of the Expo were for secondary or ready properties, while 46 percent were for properties that have yet to be delivered. In November, the value of off-plan and secondary transactions jumped by 50 percent and 27.6 percent, respectively, when compared to October.

Transaction activity in November also posted significant improvement when compared with the same period last year, with total sales jumping by 80.4 percent and value transacted rising by 138.8 percent. Property deals last month also exceeded the levels seen before the pandemic, with the total number of transactions and value in November 2021 going up by 45.4 percent and 104.2 percent, respectively, when compared with November 2019.

Source-www.zawya.com

On Saturday, officials in Dubai confirmed that the emirate had become the world’s first paperless government, thereby achieving the objectives of the Dubai Paperless Strategy which was launched in 2018.

With the Dubai Paperless Strategy fully implemented, no employee or customer of the Dubai government will need to print any paper documents or transactions, unless they personally prefer to do so. Printing can be done at service or typing centres.

The Dubai Paperless Strategy was implemented in five consecutive phases, each of which enlisted a different group of Dubai government entities. By the end of the fifth phase, the strategy was fully implemented across all 45 government entities in the emirate. These entities provide more than 1,800 digital services and over 10,500 key transactions.

Collaboration among participating entities enabled the automation of processes and services provided to customers, cutting paper consumption by more than 336 million papers. The strategy also helped save more than Dhs1.3bn and over 14 million man hours across the Dubai government.

The Dubai Paperless Strategy was launched in 2018 with an initial group of six entities: Roads and Transport Authority, Dubai Police, Dubai Electricity and Water Authority (DEWA), Department of Economic Development, Department of Tourism and Commerce Marketing, and the Department of Land and Property.

Stage one helped cut paper usage by more than 72.5 million sheets of papers.

The second phase followed in 2019, with eight additional entities joining: Dubai Courts, Dubai Municipality; Dubai Public Prosecution; Knowledge and Human Development Authority; Dubai Health Authority; Community Development Authority; Dubai Customs;and the General Directorate of Residency and Foreigners Affairs, who succeeded in reducing paper usage and saving more than 229.5 million sheets of papers.

At the end of 2019, the third phase of the strategy was announced with a new group of nine entities, namely: Dubai Corporation for Ambulance Services, Islamic Affairs & Charitable Activities Department, Dubai Media Incorporated, Department of Finance, Dubai Government Human Resources Department, Dubai Culture, Dubai Civil Aviation Authority, Al Jalila Cultural Centre for Children, and the Government of Dubai Legal Affairs Department. The group collectively cut paper consumption by more than 12.9 million sheets.

Phase four began in March 2020, with a new group of 10 entities joining the effort to implement the strategy: Dubai Statistics Center; Awqaf and Minors Affairs Foundation; Dubai Women Establishment; Security Industry Regulatory Agency; Mohammed Bin Rashid Housing Establishment; Dubai Sports Council; Ports, Customs, and Free Zone Corporation – Trakhees; Dubai Maritime City Authority; Dubai Air Navigation Services; and Dubai Airports. The group reduced paper consumption by more than 11.9 million sheets of paper.

The fourth phase also included the launch of the ‘100 per cent Digital Stamp’ initiative, which aimed to honour government entities that make significant efforts to fully implement the Dubai Paperless Strategy and provide smart services.

The fifth and final phase of implementing began in June 2020, with nine new entities joining the effort: Mohammed Bin Rashid Space Centre; Dubai Aviation Engineering Projects; Dubai Future Foundation; Supreme Legislation Committee; Nedaa Professional Communication Corporation; Mohammed Bin Rashid Al Maktoum Knowledge Foundation; Dubai Government Workshop; and the Directorate General of Civil Defense Dubai. The group saved more than 8.2 million sheets of paper in total.

Two additional government entities also recently joined the Dubai Paperless Strategy: The Financial Audit Authority Dubai and Dubai Chamber. The two entities achieved their strategic goals by 100 per cent and saved more than 938,000 sheets of paper.

“Four years ago, Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, had a vision that no Dubai government employee or customer would need to print any paper document after 2021,” said Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of The Executive Council of Dubai. “Today, that promise has been fulfilled.”

As part of its digitalization efforts and to support customers through the transition, the government’s DubaiNow app now allows access to more than 130 smart city services across 12 major categories.

Source-gulfbusiness.com

The performance of Dubai’s property market in 2021 has been nothing short of phenomenal, with transaction levels of Dh88.12 billion ($23.99 billion) in the first eight months. This surpasses the entire 2020 transactions by 22.6 per cent, according to data from real estate portal Property Finder.

It is an incredible rebound for a market that seemed to be in a perilous position when Covid gripped the UAE in early 2020. However, well-implemented government protocols brought the city back and resulted in a V-shaped recovery for the market, to the point that property prices saw an average increase of 4.4 per cent by the end of August last.

Nope, it is not

At first glance, this may seem inflationary, but prices are in line with the market. The market has hit a period of stability in terms of pricing – that means bargain-seekers are out of luck. As it stands, sellers are in a position where there is no room for offers on their property or a lot of negotiation.

The supply/demand matrix drives the market, and demand has reached unprecedented levels after Dubai emerged from the first wave of the pandemic. With the vaccination drive that started this year, the UAE’s status as the most vaccinated country in the world per capita and an infection rate that has plummeted over the past couple of months, there really is no safer place. And foreign buyers are recognizing that.

Consequently, overseas enquiries about investing or buying a primary home in Dubai have risen, and prices are keeping pace with that demand.

Instant decisions

Cash buyers are the primary market drivers at present. They do not need to depend on three-part property valuations to go ahead with a transaction. If they are interested in a property, they are ready to pay the price advertised.

Buyers who want to present offers will not be taken seriously, and mortgage buyers who get a valuation that is below asking price will either need to make up the difference somehow or risk losing out.

It should also be noted that despite increases in price, Dubai is still one of the most affordable luxury markets. Swiss bank UBS has compiled data on 25 key real estate markets, and Dubai is the only one that is undervalued.

However, sellers need to be rational about the situation. They may think it wise to hold off on selling their property in anticipation of a bigger sale in the future - but the market operates on movement and demand is at an all-time high.

If any sellers choose to hang back, they risk creating a situation where their property is out of sync with the market and ends up being unprofitable.

According to analysts at HSBC Holdings and Morgan Stanley, market sentiment is expected to remain on a high for the next 12 to 18 months, with Dubai seeing sustained growth. The bottom-line is that now is the time to buy and market price is the right price. Because if you are not willing to take the plunge, someone else will.

Source- gulfnews.com

Dubai offers a rich blend of a city life with traditional aspects of the Middle East culture. This city is home to landmarks, a robust public transportation system, diverse talents, and investment opportunities in various sectors. These, among others, make it one of the most preferred destinations for investors and professionals. With the UAE’s new visa offers and changes to owning businesses, we expect more foreign workers wanting to stay longer and more investors to enter.

The reforms were introduced in a bid to attract more talented expats, entice foreign business leaders and investors and retain those who are already in the country. This translates to excellent opportunities, particularly for those who look forward to setting up their own business. The government had always made visa renewal seamless. What makes the UAE Golden Visa more enticing is the security and flexibility that come with it. It provides long-term residency, which is one of the major considerations for an expat, for anyone interested to study, work and live in the country. In addition, it allows the visa holder to sponsor his family, adding to the stability and security.

A talent commitment

With this offer, the government is making a commitment to foreign talent that they are welcome to make the country their home, and it recognizes their contributions to the local economy. Before the visa changes, foreigners in the country have renewable visas valid for a few years and tied to employment or sponsors. The Golden Visa eliminates this, allowing foreigners to continue as long-term residents through easy renewal procedures. Golden visa holders also have the leeway to travel in and out of the country, without having to travel back every six months.

Having this long-term assurance and flexibility, foreign investors in Dubai can now easily do business without having to worry about moving around and the additional costs associated with this. It also opens equal opportunities for investors of all nationalities and creates new markets for professionals, as well as for people with specialised degrees in artificial intelligence, big data, or epidemiology and virology. A host country’s security for long-term residency influences the consumption and investment behaviour of expatriates.

Retain spending

This translates to more spending here, and lower cash outflow or transfers. In effect, it will boost domestic demand, thus strengthening the economy. Other sectors such as real estate also largely benefit. As more foreign investors and talents choose the emirate as their second home, the property market is one of the first stops.

Source- gulfnews.com

Property transactions in November 2021 reached 7,000 in volume and Dh17.96 billion in value, making it the best November on record since the government started publishing data publicly eight years ago.

According to data published by Property Finder, the total of sales transactions reached 55,651 worth Dh135.4 billion in the first 11 months, which is 88.39 per cent more than 2020 as a whole and is already the highest yearly sales figure since 2014.

Looking at overall transactions, total transaction value increased by 36.9 per cent and volume increased by 30.8 per cent compared to October. Off-plan value and volume increased by more than 50 per cent month-on-month and secondary volume increased by more than 17.4 per cent and value increased by 27.6 per cent

Since the beginning of the Expo 2020 on October 1, Dubai has recorded 12,352 real estate sales transactions worth Dh31.08 billion. This included 7,000 secondary/ready sales transactions worth Dh19.84 billion and 5,352 off-plan sales transactions worth Dh11.24 billion.

“The sales trends continue to thrive month-on-month and it’s interesting to note that November 2021 had the highest amount of sales transactions since Expo 2020 was announced in December 2013. The question on everyone’s mind is are we starting to see the effects of Expo2020 in the real estate market and the trends are giving us the answers,” said Lynnette Sacchetto, director of research and data at Property Finder.

“It is also interesting to note that 2021 to-date had the highest off-plan value since 2009 which was the peak for off-plan sales in Dubai. The data clearly shows that investors and consumers are confident in Dubai’s future which is reinforced by proactive government initiatives, attractive real estate projects and the vision of the City,” Sacchetto added.

Source- www.khaleejtimes.com

The Dubai real estate sector witnessed an exceptional growth in sales transactions in terms of volume and value last month. It recorded Dh28.5 billion sales through 9,368 transactions in November, reflecting a significant increase compared to Dh16.2 billion sales through 5,762 transactions ahead of Expo 2020 in September.

"The emirate recorded its best October over the past eight years as investors poured Dh13.12 billion in the property sector through 5,352 deals," according to the Dubai Land Department.

Industry specialists and top executives said the mega fair played a vital role in attracting foreign buyers to invest in the emirate’s growing real estate sector. The real estate market is expected to see a sharp rise in its value as long-term tenants are switching from renting to buying homes to secure themselves in one of the most sought-after destinations in the world.

In addition, the visa reforms, consistent economic policies and stimulus packages have also benefited the sector.

Expo impact

“Expo has already started showing its impact with the highest sales, capital appreciation and improvement in rentability in villas and townhouses segment. A similar kind of pattern is now visible across the board — quality apartments in downtown, in Dubai Marina and other luxurious apartment segments. Rents have started improving too,” Imran Farooq, chief executive, Samana Developers, told Khaleej Times on Saturday.

The global fair, which entered into the third month, surpassed all expectations as it welcomed approximately five million visitors during the first 60 days of its commencement. With an interesting line-up of events scheduled during the Expo, the number of visitors is expected to accelerate in December as residents and tourists are expected to throng the event over Christmas and New Year.

“Certainly, Expo is attracting new investors, buyers and people who have never bought any property in Dubai. I can see all types of developers are experiencing new markets, nationalities, people and new buyers,” Farooq said.

In reply to a question, he said it is difficult to say when would be the peak impact of Expo on the property sector. However, Expo has already given a head-start to the recovery of Dubai.

“There are other factors associated with the long-term recovery of Dubai. I am a strong believer of the golden visa, fiver-year multiple entry visa, and UAE citizenship by invitation which is a big hope that UAE will accept foreigners as longer-term residents or eventually its citizen.

“All these factors have created a very bullish sentiment in the market. The head-start recovery started with Expo expectations. In this scenario, it is difficult to predict when the peak will be. But the market should perform normally beyond Expo because of the way the UAE performed during the Covid-19 crisis, visa reforms, and Expo, all these are positive contributors. A similar impact should continue after the Expo,” he said.

Expo, a growth catalyst

Ata Shobeiry, chief executive at Zoom Property, said Expo 2020 Dubai is expected to produce better results for not only the real estate industry but also for other sectors.

“Expo visitors will get a chance to explore Dubai and get a hands-on experience of the upscale lifestyle it offers,” he said.

Shobeiry further said after a pandemic-ridden year amidst flight restrictions, people now have a chance to travel to Dubai and enjoy the global event that has pavilions set up by more than 190 countries, representing their culture, innovation and modern solutions to the global problems.

Sharp turnaround on cards

Imtiaz Rafi Butt, chairman of Rafi Group, said a sharp upturn will be seen in Dubai’s real estate very soon.

“We have an optimistic forecast on the considerable rise in property sector after lifting of Covid-19 restrictions. Long-term clients are switching from renting to buying homes to secure themselves, the recovery from economic loss is evident in the few coming years,” Butt told Khaleej Times.

He said Dubai property is on the rise after a halt of a few years, as ease in Covid-19 restrictions is applied, the rise in new comers is predicted.

“Hotels in the hub are allowed to operate at full capacity, raising hopes for the region heavily dependent on tourism. This will in turn aid both renting and buying of property to increase substantially,” he said.

The industry veteran is hoping to see the world come together in Expo 2020 Dubai and bring a new era of global relations. After two years of fighting with Covid-19, he said the world has seen a lot of advancements from technology to methodology and it is time to share the innovations to strengthen the globe.

“We are expecting Expo 2020 Dubai to become a channel of recovery for the future of the real estate market in UAE. For the past two years, the world was fighting Covid-19, Expo 2020 Dubai has opened its arms to the idea that we have to learn to live with it,” Butt said.

Expo 2020 Dubai runs until March, inviting the world to join a global celebration that will help to shape a better, brighter future for everyone.

Source- www.khaleejtimes.com