BENGALURU (Reuters) - Dubai house prices will rise for the first time in six years this year, supported by a swift vaccine rollout that has lifted hopes for an overall economic recovery, according to a Reuters poll of property analysts.

The city state’s real estate sector has been weak for years due to chronic oversupply coupled with low economic growth, a problem exacerbated by the coronavirus crisis.

But on Monday the second-wealthiest emirate in the UAE eased COVID-19 restrictions and allowed hotels in the hub to operate at full capacity, raising hopes for a region heavily dependent on tourism.

Seven of 10 real estate analysts who responded to an additional question said an acceleration in Dubai housing market activity this year was more likely. The remaining three forecast a slowdown.

“We can already see improved investor confidence and a boost in demand as prices have been on the lower side for the last few years and supply has been significantly curtailed,” said Anuj Puri of ANAROCK Property Consultants.

“The vaccination drive here also has been going well, and the economy has been gradually recovering amid government measures to spur growth.”

The May 11-19 Reuters poll of 10 analysts forecast Dubai house prices would rise 1.1% this year and 2.8% next, marking a complete U-turn in expectations from a January survey when prices were forecast to decline 2.0% in both years.

Eight of 10 property analysts said the risks to those forecasts were skewed more to the upside.

Prime Dubai properties have been snapped up in the past few months as buyers take advantage of low prices, easy credit and an economy open for business despite the COVID-19 pandemic.

Still, eight of 10 analysts who responded to another question said a sharp turn in the economy or an increase in demand were the biggest upside risks to housing market activity this year.

Dubai’s economy was projected to grow 4.0% this year after an estimated 6.2% contraction last year, according to Dubai Statistics Centre data.

Contributing about 8% to economic output, the real estate sector has shown an uptick recently, data from Dubai Land Department showed.

“The real estate market has been very buoyant since H2 2020 and continues to flourish. As more government incentives come into fruition to stimulate the economy, this will have an effect on the housing market,” said Lynnette Abad Sacchetto, director of Research & Data at Property Finder.

When asked what was the biggest downside risk to housing market activity this year, five of 10 analysts said an economic slowdown. The others said lack of demand or a lack of affordable homes.

“The only potential risk I see at the current period is that COVID-19 lingers longer than expected and further affects economic growth and tourism to the emirates,” said Simon Baker of Haus and Haus.

Source:https://www.bloomberg.com/

DUBAI: Sales of prime villas and apartments in Dubai rebounded in the first quarter of 2021 helped by a decline in prices as the emirate’s property market looks to recover from the coronavirus pandemic.

The value of sales in the prime real estate segment rose 25 percent from the previous quarter to 11.6 billion dirhams ($3.16 billion), Luxhabitat Sotheby’s said, citing data from the Dubai Land Department. A total of 3,450 apartments and 586 villas changed hands.

Properties in Palm Jumeirah topped the charts in terms of sale value at 2.70 billion dirhams, followed by Mohammed bin Rashid City with 1.37 billion dirhams and Business Bay at 1.27 billion dirhams.

Prime apartment prices fell 6.3 percent to an average of 1,315 dirhams per square foot, leaving the mean apartment costing 2.07 million dirhams. The average selling price of a prime villa increased by 3 percent while the average size increased by 10 percent, suggesting a decline in price per square foot.

The most expensive property transaction in Dubai in the first quarter was a 11,950 square foot villa on Frond N in Palm Jumeirah for 111.3 million dirhams. Second was a 44,952 square foot home in Sector R of Emirates Hills for 68 million dirhams.

Source:https://www.arabnews.com/

DUBAI: The UAE will allow foreigners to start a company without an Emirati shareholder from next month as the regional race to attract investment heats up.

The change, which comes into effect from June 1, could also spur demand for commercial and residential property, said brokers.

“The amended Commercial Companies Law aims at boosting the country’s competitive edge and is a part of UAE government efforts to facilitate doing business,” said Minister of Economy Abdulla bin Touq Al-Marri, in a statement carried on the UAE’s official WAM news agency.

Previously companies needed either to have an Emirati shareholder or be based in a dedicated business park known as a free zone.

The announcement comes as Gulf governments ramp up efforts to attract foreign investors. Saudi Arabia said earlier this year it would stop signing contracts with foreign companies from 2024 unless their regional headquarters were based in the Kingdom. Neighboring UAE has also announced a number of other incentives to encourage firms to establish bases in the country.

It was not immediately clear how the UAE’s many major free zones will now seek to attract new tenants, however some are already shifting focus.

The Dubai Airport Free Zone Authority (DAFZA) said on Wednesday that companies trading with crypto assets could now obtain a business license in a new agreement that supports the mainstream use of blockchain technology. The free zone agreed with the Securities and Commodities Authority (SCA) to allow the regulation, offering, issuance, listing and trading of crypto assets within DAFZA.

Analysts said the move could help to spur demand for commercial and residential homes as business owners set up shop in the emirate.

“The federal and local governments across the UAE continue to unveil key policy initiatives that will be crucial in helping to create future demand for residential and commercial property across the country,” said Faisal Durrani, head of regional research at Knight Frank. “With this landmark change, the UAE has unlocked its potential to emerge as a key global contender (for) business headquarters, which were previously confined to free zones across the country. At the smaller end of the business spectrum, fresh initiatives such as ‘Dubai Next’ will certainly help to position cities such as Dubai as an attractive option for global startups looking for a dynamic launch location”.

Source:https://www.arabnews.com/

DUBAI: Wealthy Hong Kong expats could be tempted to move to Dubai, lured by cheaper homes, an attractive visa regime and a robust vaccination program, a report claims.

Dubai has liberalized its visa regime, falls under the UAE’s Abraham Accords with Israel, has maintained a globally rare sense of normality during COVID-19 in terms of outdoor activities and open schools, and is efficiently vaccinating its population, Tellimer said in a research note to clients on Tuesday.

The cost of living and cheaper house prices could also prove to be a draw.

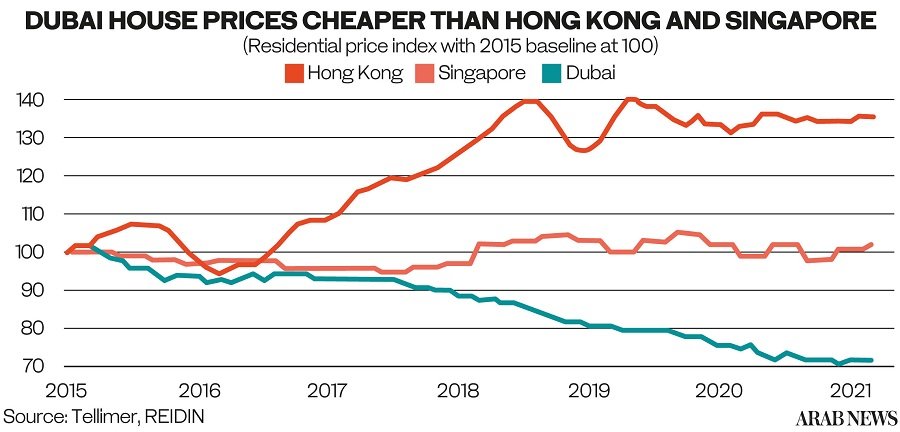

Dubai now has a cost of living more than 20 percent below Hong Kong and Singapore — the main driver of which is its cheap property market where prices are down 30 percent since 2015. By comparison, Hong Kong real estate prices rose 35 percent over the same period while they were largely flat in Singapore.

The freeze of assets this month of entrepreneur, media-owner, and pro-democracy supporter, Jimmy Lai, is the latest symbol of the change in Hong Kong since the introduction of the national security law in June 2020, Tellimer said. The move could encourage some of Hong Kong’s wealthy elite to consider moving, it said.

“For rich expatriates who are affluent enough to move for lifestyle and wealth preservation, as much as income generation, Jimmy Lai’s example may serve as another nudge to consider cities like Singapore, a migration underway for some time judging by the anecdotal evidence of private banker relocations and hiring trends,” said report author Hasnain Malik. “Arguably, a more intriguing, and less well-trodden, alternative for rich expats and global emerging market equity investors has emerged in Dubai.”

Dubai recently relaxed its visa system in an effort to attract more people to the emirate which was hit hard by a regional economic slowdown even before the onset of the coronavirus pandemic. However the emirate's battered property sector is now showing signs of stabilization with a recent price rebound at the luxury end of the market.

Source:https://www.khaleejtimes.com

The rally in Dubai’s residential property prices isn’t stopping anytime soon, according to Morgan Stanley.

“Robust demand, peaking supply growth and long lead times for new projects could lead to a tighter-than-expected market over the next several years,” analysts Katherine Carpenter and Nida Iqbal wrote in a report.

Business activity in Dubai, the Middle East’s main financial hub, has risen to the highest level since late 2019 because of a rebound in tourism and a fast distribution of coronavirus vaccines. The United Arab Emirates, a federation of seven sheikdoms including Dubai, has one of the highest inoculation rates globally.

Demand picked up amid “a wave of government reforms over the past 12 months, attractive mortgage rates, and a shift in demand patterns due to Covid-19,” according to Morgan Stanley.

A gauge tracking real estate shares in Dubai has gained about 8% this year, though it’s still down 74% from a peak in 2014. Emaar Development, a unit of Emaar Properties, surged as much as 9.5% on Tuesday.

Source:https://www.bloomberg.com/

A purchasing managers’ survey revealed that during April, Dubai’s non-oil private sector showed a speedier rebound as business conditions were strengthened by marked increases in output and new business.

Dubai's private sector is witnessing the strongest demand growth in 18 months on the back of a faster overall recovery and higher business confidence facilitated by effective Covid-19 vaccine rollout.

A purchasing managers' survey revealed that during April, Dubai's non-oil private sector showed a speedier rebound as business conditions were strengthened by marked increases in output and new business.

"Most notably, sales growth reached the quickest since October 2019, supported by higher business confidence as the Covid-19 vaccine roll-out continued at pace," said the IHS Markit Dubai Purchasing Managers' Index report.

The PMI is derived from individual diffusion indices which measure changes in output, new orders, employment, suppliers' delivery times and stocks of purchased goods.

David Owen, economist at IHS Markit, said the recovery in the Dubai non-oil economy sped up in April, as output and new order growth returned to pre-Covid trends and business confidence strengthened to the highest in over a year.

"Travel & tourism firms recorded the most notable bounce back in performance, amid increasing hopes of a rise in tourism activity later in the year, boosted by the rapid vaccine roll-out," said Owen.

Dubai Tourism Chief Executive Issam Kazim said last week that he was very optimistic business and leisure travellers would return this year, though the pandemic made it difficult to predict exactly how many. Dubai, a trade and tourism hub which has kept its borders open since reopening last July, saw 1.26 million visitors in the first quarter, while last year the number of visitors fell 67 per cent to 5.5 million. "We are very optimistic on the numbers for the year with key events, like the multi-month Expo 2020, which starts in October, helping to attract visitors to Dubai," Kazim said.

After recording a decline throughout the first quarter, new work rose at the strongest rate since the end of 2019.

"With demand strengthening, non-oil firms brought the recent run of falling output charges to an end in April, as prices were lifted for the first time in three years. Cost inflation meanwhile eased from March and was slower than the rate of selling charge inflation. This signals a slight improvement to operating margins after a long period of pressure from price discounting," said Owen.

The Dubai PMI rose from 51.0 in March to 53.5 in April, signalling a solid expansion in the non-oil private sector economy. The reading was also the highest recorded since November 2019, suggesting the economy is moving closer to its pre-Covid growth trajectory.

According to the survey, the most positive result in the latest survey was the New Orders Index, which pointed to the quickest rise in customer sales for a year-and-a-half. "The upturn was helped by strengthening business optimism about the coming year as the impact of the Covid-19 pandemic is expected to recede."

Another major catalyst to Dubai's widely anticipated speedy recovery is the real estate sector which has started to show strong signs of rebound over the past few months. Dubai's fast rebounding property sector recorded a total sales transaction value of Dh10.97 billion in April 2021, the highest since March 2017, according to a real estate portal.

April also witnessed 4.2 per cent more than March 2021 in terms of volume and 0.6 per cent more in terms of value. This brings the year to date total to 16,577 transactions worth Dh36.12 billion, Property Finder said in its report.

Abdulla bin Touq Al Marri, the UAE's Minister of Economy, has said the positive growth rates of the national economy would be restored by the end of 2021, estimating a 2.5 per cent growth in real GDP, and 3.6 per cent in non-oil real GDP. These figures are expected to rise to 3.5 per cent growth in real GDP, and 3.9 per cent growth in non-oil real GDP in 2022, he said, citing estimates released by the Central Bank of the UAE.

The PMI survey shows faster increases in new work in the wholesale & retail and construction industries compared to the previous survey period. "As a result, non-oil private sector companies raised output for the fifth consecutive month in April, with the rate of expansion quickening to its highest since July 2020. There was also a third increase in staff numbers in four months, reflecting efforts to rebuild business capacity," said the report.

While demand for inputs rose solidly at the start of the second quarter, which put pressure on suppliers as average lead times lengthened to the greatest extent since last May, some firms found that input supply struggled to match demand due to global shortages, leading to a slight increase in overall costs, said the PMI report.

Source: https://www.khaleejtimes.com/

ValuStrat research shows average 1.2% increase in capital values in April, the best performance in seven years

Dubai real estate prices registered their biggest growth rate in April for seven years, according to new research by consultants ValuStrat.

Its VPI – Residential Capital Values for Dubai for April expanded 1.2 percent to 67.3 points, the index's best performance since 2014.

On a citywide level, capital values of residential homes commenced a growth trend, a promising signal that the property market has bottomed out, ValuStrat said.

It added that clear improvements in capital values were observed in 96 percent of locations monitored by the VPI.

Annually, the valuation-based index was 6.5 percent lower than the previous year, a notable improvement on recent double-digit annual declines.

ValuStrat noted that April continued the ongoing growth trend, with residential sales volumes rising 16.9 percent over the previous month.

Its research also indicated that off-plan and ready homes monthly sales increased by 30.1 percent and 8.7 percent respectively.

Freehold locations monitored by the VPI saw villa and apartment capital values expand monthly by 1.1 percent on average.

The report said improvements in apartment values were observed in Jumeirah Beach Residence, Palm Jumeirah (pictured above) and Jumeirah Lake Towers with an average monthly growth of 1.5 percent.

Villa freehold locations registered monthly increases that averaged a higher rate of 2.1 percent in April while a record 3 percent monthly gain was seen in Jumeirah Islands.

Sales of existing ready-to-move-in homes in April exceeded the whole second quarter of 2020, a time when lockdown measures were put in place due to the Covid-19 pandemic, ValuStrat said.

Villas in Dubai Hills Estate and Palm Jumeirah registered their highest ever individual monthly sales volumes, it added.

According to the report, properties developed by Emaar, Nakheel, Damac, Dubai Properties, MAG Property Development topped the salescharts overall.

Top off-plan locations transacted during April were in Dubai Harbour, Mohammed Bin Rashid City – District Seven, Jumeirah Lake Towers, Jumeirah Village, and Arjan while most transacted ready homes were located in Dubai Marina, Jumeirah Village, Dubai Sports City, Palm Jumeirah, and Town Square.

Source:https://www.arabianbusiness.com/

Dubai’s population is expected to increase from the current 3.4 million to 5.8 million by 2040.

Residential property demand in Dubai will remain substantially strong over the next two decades, as the emirate will require almost the double of existing supply, because of a likely increase in the city’s population, according to industry analysts.

According to the Dubai Statistics Centre, the supply of apartments and villas in Dubai is over 690,498 units as of 2020, catering to the city’s 3.4 million (m) population.

Analysts estimate that Dubai will require between 483,000 and 550,000 additional residential units over the next two decades to accommodate its estimated 5.4m population by 2040.

The requirement of new units is estimated between 24,150 and 27,500 a year.

Under the 2040 Urban Master Plan that was launched in early March, Dubai’s population is expected to increase from the existing 3.4m to 5.8m by 2040. The emirate will have five main urban centres, including two new ones.

“Assuming an approximate household size of 4.9 per unit based on the population estimate of 3,411,200 from Dubai statistic centre as of 2020, around 483,550 additional units will be required by 2040. This works out to around 24,000 units per year for the next 20 years,” said Prathyusha Gurrapu, Head of Research and Advisory at Core.

“Developing further on strong fundamentals, Dubai’s 2040 Urban Master Plan reinforces Dubai’s competitiveness as a global destination while creating an environment where people from around the world can thrive with sustainability, diversity and inclusiveness as key focus areas,” she added.

Taimur Khan, Associate Partner at Knight Frank, said the quantum of additional supply required over the next two decades is subjective and would be contingent on a number of quantitative and qualitative factors, some of which could see a marked change over the short to medium term.

“Currently, the total number of residential units in Dubai stands at around 555,000. To service the total expected population level by 2040, we’re likely to need this number roughly double,” said Khan.

Knight Frank estimates that the total number of apartments’ units in Dubai is at around 472,000.

Khan said developers would have to understand how household incomes could change going forward and what would be its impact on demand on new housing units.

“The likelihood is, whilst there will be a range of opportunities for developers from the affordable to the super-prime segments of the market, the middle-income segment of the market is likely to require the most significant quantum of supply to be delivered,” Khan added.

Source:https://www.khaleejtimes.com/business/real-estate

- The value of property transactions jumped 40 percent YOY in March

- Real-estate agents earned 392 million dirhams in commission in Q1

RIYADH: Dubai real-estate transactions jumped 43 percent year over year in March 2021 to 6,590 as investors flooded back into the sector.

The value of sales rose 40 percent to 22.9 billion dirhams ($6.2 billion), according to the real estate bulletin issued by Dubai Land Department (DLD), WAM reported. The number of transactions was the second highest monthly total since February 2017.

The bulletin highlighted continued attractiveness of the real estate sector to new investors, with 5,683 entering the market in Q1 2021, representing 64 percent of the total number of investors in the period.

The value of commissions achieved by active real estate brokers reached 392 million dirhams in Q1 2021, while 143,374 rental contracts were recorded in Q1 2021, 57 percent of which were new contracts and 43 percent were renewed.

The bulletin highlighted the top five areas for investor attractiveness. In villa sales, Hadaeq Sheikh Mohammed Bin Rashid topped the list in Q1 2021, followed by Wadi Al Safa 5, Wadi Al Safa 7, Nad Al Sheba 1, and Al Thanyah Fourth. In apartment sales, Dubai Marina, Palm Jumeirah, Business Bay, Burj Khalifa, and Al Merkadh topped the list in Q1 2021.

Sales of luxury villas, sea-view apartments and second-hand family houses jumped in March, re-energizing a property market that saw a sharp fall in activity at the height of the pandemic and had been in a five-year slump prior to that, Reuters reported at the time.

S&P Global credit analyst Sapna Jagtiani does not expect Dubai’s real estate market to recover to pre-pandemic levels until next year, the agency said.

Source:https://www.arabnews.com

Investors decide to wait as realty prices recover, analysts say

As the property prices recover in Dubai, investors are holding back the sale of their assets to bargain for a better price, as an element of greed has set in, according to analysts.

They said signs of recovery in the real estate sector are underway and the newly announced regulatory measures, local availability of the vaccine, and the upcoming Expo 2020 festivities will help further revive the sector during this financial year (FY).

“During the first quarter (Q1) of FY 2021, it has become apparent that due to the consistently high numbers of buyers in the market, we have seen a transition into a seller’s market. We have identified that over this period many homeowners are holding out for a ‘better price’ and an element of greed is now beginning to set in with owners’ expectations,” analysts at real estate consultancy Colliers said in their latest report.

“This inflated owner expectation accompanied with a supposed shortage of supply is causing prices to spike in a relatively short period of time,” the analysts said in their Q1 report.

The Colliers survey found that the majority of participants in its survey agreed that currently the quantity of buyers registered outweighs the supply in popular areas within Dubai, as agents informed the firm, they are running low on inventory.

Real estate consultancy JLL said lower sales prices have yielded a 15 per cent increase in sales volume for Dubai in Q1 2021, as compared to the corresponding period last year.

More end-users have taken the opportunity to enter the market because of the affordability factor.

Investors closing on attractive villa and townhouse deals have led to marginal recoveries in sale prices of 2-3 per cent, as compared to the previous quarter, said Dana Salbak, head of research at JLL Mena.

Dubai’s residential market stock increased to 607,000 units after an addition of 10,000 units in Q1 2021, JLL said.

The firm added that for the remainder of FY 2021, an additional 46,000 units are expected to be added.

In Abu Dhabi, around 200 residential units were delivered, bringing the total stock to roughly 265,300 units.

By the end of FY 2021, approximately 11,700 units are scheduled to enter the market, according to JLL.

Strong demand for villas

In the residential sector, villa sale prices increased by 3.5 per cent and 2 per cent in Dubai and Abu Dhabi, respectively, when compared to the same period last year, it said.

As work from home (WFH) has become a central aspect of post-Covid-19-pandemic life, JLL observed that strong demand for good quality villas and townhouses have been driven by end-users capitalising on favourable payment plans, lower prices and opportunities to upgrade space.

Analysts at said properties adapting to shifting consumer demands reflect the domestic market is evolving.

It said a large emphasis of the FY would be re-envisioning spaces as tenant and end-users find community amenities more appealing.

“As roles of different properties are shifting, property managers will need to offer residents an optimal way of living and working with a blended and multi-purposed dynamic. The successes and failures of the multi-purpose concepts will provide an opportunity and insight into how the modern-day tenant has evolved, allowing the future of real estate to take a step forward in creating properties that are adaptable to an individuals’ needs,” Salbak added.

Source:https://www.khaleejtimes.com/business/real-estate