New Bayut and Dubizzle research says confidence has returned among buyers in the Dubai real estate market

Sales prices for popular areas in Dubai are the highest seen in the market since 2014, according to the CEO of Bayut and Dubizzle.

Haider Ali Khan said the rise in prices in most locations in the city was a "good measure of the confidence" that property seekers currently have in Dubai’s real estate market.

“This year has really started off on a good note for the Dubai real estate market. In the first quarter of 2021, we have seen an impressive growth in demand; prices have increased in most of the key areas and the volume of transactions have also gone up.

“We have also noticed that there is a lot of positive sentiment in the market, thanks to the recent announcements from the government, both locally and internationally... All of this points to the fact that there is a growing appetite for residential space in the city; a trend that we could see transitioning into the rest of the year as well,” Khan (pictured below) added.

His comments come as Bayut and Dubizzle released a new report that showed sales and rental prices in the most popular neighbourhoods have shown growth while demand has risen for luxury real estate in particular.

It cited lower interest rates, higher loan-to-value ratios and attractive property prices over the last year as reasons for the strong Q1 performance.

The report added that favourable market conditions, combined with the growing need for bigger living spaces and access to recreational amenities by end-users, have been driving demand, particularly for ready-to-move-in homes.

Government initiatives have also played an integral role in further enhancing Dubai’s appeal to a wider audience.

Landmark announcements regarding the UAE Citizenship Law and remote work visas have also led to strong investor sentiment while proactive measures to combat the ongoing pandemic and the organised vaccination campaign have further built on the city’s reputation as one of the safest places to live in the world.

According to data published by the Dubai Land Department (DLD), 62 percent of total investors in January and February 2021 were new home buyers, highlighting the city’s growing appeal with first-time buyers, the report noted.

Combined sales and rental data released by Bayut and Dubizzle has revealed that properties for sale in Dubai experienced price increases between 2-10 percent in Q1. Rental costs also increased by up to 10 percent in Dubai’s luxury segment, while the affordable housing market recorded decreases of up to 13 percent.

Dubai recorded 6,328 transactions for residential properties worth AED8.9 billion in the first quarter of 2021.

According to Bayut and Dubizzle, Dubai’s luxury apartment segment recorded an impressive uptick in sales prices, pointing to growing demand for upscale homes.

Source:https://www.arabianbusiness.com

With the Expo now getting closer, many commentators are wondering if Dubai will be able to ensure that the event delivers on its previous successes in the midst of pandemic-induced un-certainties

World Expos are platforms for host countries to exhibit their cities and flaunt their culture to a global market while formulating indelible international relations. Following suit, Expo 2020 will be a spectacular happening that will allow Dubai to showcase its brilliance, innovations, break-throughs, and vast potential for a bright future, all to a global audience.

With the expo now getting closer, many commentators are wondering if Dubai will be able to ensure that the event delivers on its previous successes in the midst of pandemic-induced un-certainties.

The UAE has invested $8.7 billion to reap $17.7 billion in gearing up for Expo 2020 and making sure that it is going to be a successful event, post-pandemic.

Ephemeral event with long-lasting impact

Shanghai hosted the highest number of visitors in 2010, welcoming a record-breaking 73 million attendees. Infrastructure, such as subway lines, air terminals, railway stations and the general urban structure, was given a face lift with an expo investment of about $45 billion. Tourism also soared — 13 per cent during the Spring Festival alone, while residential property-leasing vacancy rates fell from 15 to eight per cent during the expo. Demand for hotel rooms shot up 39 per cent from the expo happening in 2010 to 2019, and the average daily rate also increased by 30 per cent.

Riverfront properties, which were stamped as an outdated shipyard pre-expo, caught the eye of foreign investors who redeveloped and converted them into profitable retail and commercial ventures.

When Milan hosted the Expo in 2015, the hospitality industry and commercial services witnessed a hike of 1.3 to 4.2 per cent throughout the year; €6 billion was injected through foreign direct investment within three months.

Similarly, Japan also hosted a successful Expo in 2005 with 22 million visitors, 880,000 of whom were foreigners.

Dubai continues to lead the pack

Dubai has taken major steps and introduced sweeping changes to consolidate its position as the most resilient, future-focused and proactive city on the global map.

Policies in Dubai are formulated to stimulate the economy and make businesses thrive. Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of the Dubai Executive Council, released a Dh1.5 billion economic stimulus package for businesses when the pandemic hit last year. Furthermore, the relief package aimed to reduce the living cost for the residents across properties and industrial arenas when the government rolled out a 10 per cent discount on water and electricity bills.

As part of the emirate’s unremitting pursuance towards supporting the business community, to weather the challenges posed by Covid-19, a Dh50 billion fund was put to play to ensure business continuity and stability.

According to economic reports released by the Central Bank of the UAE, the collective value of all capital and liquidity measures adopted by the authority since the 14th of March 2020 increased to Dh256 billion, including Dh50 billion in capital buffer relief, Dh50 billion in zero-cost funding support, and Dh95 billion in liquidity buffer relief. The central bank also projected a growth of 3.6 per cent for non-oil sectors.

Dubai has been strong in its preparations for Expo 2020 as growth and equilibriums as results of policy changes, technological implementation, and innovation in sustainability and infrastructure were widely noticed. The city anticipates a booming growth in sectors such as construction, tourism and hospitality, as well as looks to attract huge investments in real estate, environmental avenues and public affairs as a result of the expo.

Expo’s impact on Dubai’s economy

According to a statement from the Expo 2020 executive body, the total GDP will stand at Dh24.2 billion, while a report by Ernst & Young suggests Dubai’s economy will push up to about $33.4 billion as the country prepares to host millions of visitors despite the pandemic. Sectors such as events organisation, construction, and hospitality will contribute Dh68.9 billion, Dh27 billion and Dh11.4 billion, respectively.

A total investment of Dh40.1 billion will be put in in terms of infrastructure and capital as-sets. Event and legacy infrastructure will be allocated Dh53.5 billion.

Sustainability and technology have been highly incorporated for the Expo as the new Mohammed Bin Rashid Al Maktoum Solar Park will provide clean energy and facilitate charging stations for electric cars, and canopies will be covered with solar-panels with the ability to capture water from moisture and air around it, revolutionising sustainable energy sourcing.

Dubai, well-known to achieve the unthinkable, has taken up the challenge of making Expo 2020 the most digitally connected Expo in the history of the event. The latest technology and automation, such as AI and 5G, will play a major role in connecting the site via the Internet of Things. Data will be gathered and visualised via Navigator, a cloud-based energy management platform from Siemens.

The Red Line Dubai Metro has also been extended by 15 km from Jebel Ali Station as a convenient means to arriving at the Expo site. Infrastructure is an integral part of the economy as 301 individual projects worth $100 million are in their execution stage. The innovations in sustainability, technology and infrastructure will boost Dubai’s economic growth between 3.8 and 4.5 per cent over a span of five years, estimates suggest.

Dubai’s impeccable efforts

Expo 2020 will be a catalyst to boosting a broad spectrum of sectors in the name of innovation and development. It is not merely the preparations and the happening of the event itself, but especially the after-effects it will have a positive impact on the economy, with Expo 2020 rep-resenting a gateway to the world, putting Dubai on the world stage, facilitating the formation of business relationships, and attracting tourism and population increases in the long term.

Source:https://www.khaleejtimes.com

There are nine main supporting factors that have contributed to the growth of the value of real estate transactions in Dubai during the first quarter of 2021, increasing 44 per cent on an annual basis, according to the chairman of brokerage W Capital.

According to Walid Al Zarouni, these include a strong Covid-19 vaccination drive, new visa residency laws, and the upcoming Expo 2020 Dubai event.

Al Zarouni revealed that the Dubai Land Department’s data showed a growth in real estate transactions value to Dh68.6 billion in the months January to March of this year, as there were 18.526 transactions. The value of real estate transactions was Dh47.7 billion, compared 14,684 transactions in the same period of 2020. The data showed that sales recorded an annual growth of 16 per cent reaching Dh24.8 billion, through 11,658 deals, while the value of mortgages during the same period amounted to about Dh39.5 billion, with an annual growth of 76 per cent with 8,091 deals.

In addition, real estate donations reached Dh4.8 billion, with 828 deals during the first quarter of this year. Al-Zarouni pointed out that ready real estate share of sales was the largest at 80 per cent, equivalent to Dh19.8 billion, compared to 20 per cent of off-plan sales at a total value of Dh4.9 billion. Sheikh Mohammed bin Rashid Gardens ranked the best of the five areas in terms of sales value for apartments and villas during the first quarter of 2021, followed by Wadi Al-Safa 5, Wadi Al-Safa 7, Nad Al Sheba 1, and Al Thanayah Fourth. With regard to the apartment category, the lead came as follows: Dubai Marina, Palm Jumeirah, Business Bay, Burj Khalifa, and Merkad, respectively.

Walid Al-Zarouni noted that the sales recovery reflects optimism during 2021, as the investment incentives provided by the emirate authorities and government initiatives in support of population growth, boosted the direct demand for real estate. Al-Zarouni also highlighted the ‘Dubai Urban Plan 2040’, which is aimed at making the Dubai the best place in the world for living and working. The plan focuses on achieving a global development model supporting the well-being of society, empowering people and motivating them.

Al-Zarouni indicated that the widespread Covid-19 vaccination centers in the UAE are a key driver of Dubai’s real estate sector’s recover in the first quarter of this year. He also said that the amendment of some provisions related to the executive regulations of the Federal Law regarding nationality and passports, through which the granting of Emirati nationality to investors, professionals, talents and their families, based on a number of terms and conditions, is a qualitative shift for the real estate sector, as it creates a new demand for the sector that decrease supply and paves the way for launching new projects.

In addition, he says that there is no doubt that hosting the Dubai Expo 2020 and spending to develop infrastructure projects will enhance the demand for rent in the emirate, as well as boost investment in the real estate sector in the coming years. Research studies estimated the added value in the post-Expo period to be at Dh62.2 billion until December 2031.

Al-Zarouni said that the real estate sector will also benefit from the approval of granting golden residency to residents for a period of 10 years for several categories, most notably those with doctoral degrees, all doctors, and engineers in the fields of computer engineering, electronics, programming, electricity and biotechnology. “Such decisions enhance the purchasing power of real estate as the targeted groups seek settlement in the country, raise the value of foreign investments inflows, and help create new jobs.”

Al-Zarouni said that the emirate of Dubai provides qualitative facilities to attract local, Arab and foreign investors, as it has decided to reform the Commercial Companies Law and cancel the requirement that some local companies have an Emirati shareholder and allow foreigners 100 per cent ownership in 122 commercial activities. This is expected to boost foreign direct investment in the UAE in general and the real estate sector in particular.

Al-Zarouni also said that the risks of the pandemic diverted attention towards obtaining independent and larger living spaces, whereas the remote work policies reinforced the tendency to acquire larger homes suitable for living and working together. He expects those policies to continue after the pandemic. He also said that the decrease in the number of new projects helps to reduce the real estate supply amid the growth in demand, which supports the growth of prices to satisfactory levels, and increases the attractiveness of domestic and foreign investment.

Also, UAE banks have introduced a reduction in interest rates on mortgage loans, which encourages people to buy residential units instead of renting, at a time when prices have reached levels that make investing in real estate in Dubai a good opportunity. Lastly, Dubai's reserved its position as the best financial and business destination in the Gulf region. This is helping to increase the demand for offices and boost the turnout, thanks to the speed of vaccination campaigns.

Source:https://www.khaleejtimes.com

Dubai is being considered a viable alternative to many European cities due to its successful handling of the Covid-19 pandemic, according to global property consultant Savills.

Dubai has emerged as the location of choice, especially for technology companies, keen to expand in the region. More interestingly, it is also now being considered as a viable alternative to many European cities due to its handling of the pandemic, balancing an effective inoculation drive, whilst keeping the Dubai economy open for business,” Savills said in a commentary on Dubai’s office market.

Swapnil Pillai, associate director, research, Savills, said after a year of remote and hybrid working, most corporate occupiers are taking a longer-term view on their real estate requirements.

“Occupiers are more proactive and now initiate discussions with landlords on lease renewals/restructuring — in most cases, well in advance of their lease expiry, based on their future real estate strategy… A prolonged uncertainty around sustained global economic recovery has led companies to prioritise flexible leasing options. This has increased the demand for co-working and serviced office space,” she said.

According to Emirates NBD Research, commercial properties saw a decline in yearly rents in the first quarter of the financial year 2021, largely as ongoing Covid-19 precautions mean many businesses are still urging some employees to work from home to limit the contagion risk.

Office rents were down 17.8 per cent year-on-year and 2.6 per cent quarter-on-quarter. The commercial property market has faced oversupply challenges prior to the pandemic, adding further to the price pressures we are seeing in this segment.

Source:https://www.khaleejtimes.com

Emirate saw sales of more than 6,000 ready homes in the first quarter, worth AED13.5 billion, and 3,600 off-plan properties worth AED5 billion

The first three months of the year witnessed the highest recorded number of home sales transactions in Dubai since 2010, according to the latest Q1 real estate market report from Valustrat.

As the emirate’s real estate industry continues to recover from the twin shocks of a legacy glut in supply and the coronavirus pandemic, the city saw sales of more than 6,000 ready homes in the first quarter, worth AED13.5 billion, and 3,600 off-plan properties worth AED5 billion.

The report said: “When compared to the previous quarter, ready home sales were up 17.4 percent and off-plan sales were 8.9 percent higher.”

The median transacted price for ready apartments stood at AED9,171 per square metre (AED852 per sqft), which is up 9.8 percent on the previous quarter and up 1.5 percent year-on-year; for ready villas, the median transacted price was AED9,580 per sqm (AED890 per sqft), up 15.3 percent QoQ and 13.7 percent year-on-year.

According to the report, there were approximately 7,294 units completed during the first quarter, equivalent to over 12 percent of total expected supply this year (estimated supply for 2021 is 46,316 apartments and 10,563 villas/townhouses).

n terms of residential rents, there was an overall fall of 11 percent year-on-year in Dubai, although this was not reflected across the board, with apartment rents down 18.4 percent compared to the same period last year, while villa rents jumped 3.9 percent.

Average annual rents for two-bed villas stood at AED103,000; three-beds at AED150,000; and four-bedroom villas at AED212,000. Average rents per annum for studio apartments were AED35,000; one-bed at AED52,000; two-bed AED78,000; and three-bedroom apartments were AED114,000.

The report said residential occupancy in Dubai is currently estimated at 80 percent.

Source:https://www.arabianbusiness.com/

Almost 50,000 sqm of total Gross Leasable Area sold across the emirate in the first quarter of the year, according to latest Valustrat report

As the debate rages between in-person, online and hybrid methods of future working, the demand for office space in Dubai shows little signs of abating, with 49,849 square metres (536,575 square feet) of total Gross Leasable Area sold across the emirate in the first quarter of the year, worth AED420 million.

According to the latest Q1 Dubai Real Estate Market report from Valustrat, office sales transaction volumes during the first three months of the year were 41 percent higher compared to the previous quarter and up 45.7 percent year-on-year.

Ticket sizes were 16.2 percent higher than last year, but 21.7 percent lower than Q4 2020. While the median transacted price stood at AED7,013 per sqm (AED652 per sqft), which was “stable” quarterly, but nine percent lower than last year.

The report revealed that Business Bay was the most popular choice for office sales, with a share of 43 percent, followed by Jumeirah Lake Towers (JLT) with 39 percent of overall transactions for Q1.

It added that the average size of offices sold in Business Bay was 106 sqm (1,143 sqft) and 107 sqm (1,448 sqft) in JLT.

In terms of office rents, according to the report, these remained “relatively stable” quarterly, but witnessed a 3.2 percent annual decline. However, it added: “Asking rents for this quarter were 13.7 percent lower than two years ago.”

The citywide median asking rent for a typical office size stood at AED835 per sqm (AED78 per sqft).

In a breakdown of locations, it was revealed that the median asking rents commanded by Dubai International Financial Centre (DIFC) were at AED1,650 per sqm (AED153 per sqft) for typically sized units between 93-186 sqm (1,000-2,000 sqft).

In Business Bay, this figure was less than half at AED815 per sqm (AED76 per sqft) for similar sized office areas.

Office occupancy in the emirate was estimated at 77.6 percent.

Source:https://www.arabianbusiness.com

Khalaf Al Habtoor remains positive on UAE outlook following a strong start to the year

The UAE has a promising future ahead and the emirate proved its resilience once again by successfully handling serious challenges such as the Covid-19 pandemic, according to an industry veteran.

Khalaf Ahmad Al Habtoor, founding chairman of Al Habtoor Group, appreciated the UAE leadership for handling the pandemic with extraordinary measures that paves the way for quick economic turnaround of the country.

Referring to the latest data published by the International Monetary Fund (IMF), STR, and the Central Bank of the UAE, Al Habtoor said his earlier predictions for UAE economic growth in 2021 have ‘exceeded expectations’ as the UAE successfully navigates the challenges.

“The UAE has once again shown its resilience. My country’s ability to navigate the challenges around Covid-19 is highly commendable,” Al Habtoor said in a statement to Khaleej Times on Tuesday.

He said global economic growth was already on the decline in all regions of the world in 2019, and Covid added significant pressure. However, the economic recovery in the UAE has been on the upward trajectory since the third quarter of last year.

“We continue to see pockets of positive growth, and as a result, real GDP is forecast to hit, or exceed, 3 per cent this year,” said Al Habtoor, who successfully operates one of the largest privately-owned business conglomerates in the region.

Promising growth outlook

The IMF has forecasted in its World Economic Outlook the UAE economy to grow 3.1 per cent in 2021, observing that the global growth outlook “hinges on how effectively economic policies deployed under high uncertainty can limit lasting damage from the crisis”.

The UAE central bank is forecasting further growth next year with the UAE’s economy seen climbing to 3.5 per cent in 2022.

About the diverse industries that Al Habtoor Group operates, the founding chairman said the first quarter of 2021 has seen extensive growth in the real estate division of the group, achieving a significant surge in the volume of sales compared to the same time before Covid.

Dubai real estate transactions soared 27 per cent and 47 per cent during the first quarter of 2021 compared to same period last year and 2019, respectively; surpassing pre-Covid transactions and suggesting that confidence is restored, according to the Real Estate Bulletin issued by the Dubai Land Department.

“All our hotels in the UAE are performing extremely well. We have witnessed a very healthy first quarter and are expecting a great second half of the year. Our base business for the remainder of 2021 is very solid with high occupancy rates already achieved,” Al Habtoor said.

In its latest report, hospitality data and analytics specialist, STR showed a rebound in hotel occupancy rates in the UAE in the first quarter of 2021, particularly in Dubai, which recorded the highest occupancy rates in the world in March. The report showed Dubai occupancy rates rose to more than 60 per cent in March 2021, one of the strongest performance markets in the world.

“This healthy performance is reflected in all the sectors of business we are operating in, including our automotive and car leasing divisions,” Al Habtoor said.

“Consumers are spending again, and confidence has returned in the UAE,” he added.

“This good performance in first quarter of 2021 is only the beginning. I am expecting double-digit growth across the board in our group. With more than 10.66 million people vaccinated in the country, we are well on the way to returning to normal life. Proving one more time that the United Arab Emirates is the safest place on earth for businesses and investors,” Al Habtoor concluded.

Source:https://www.khaleejtimes.com

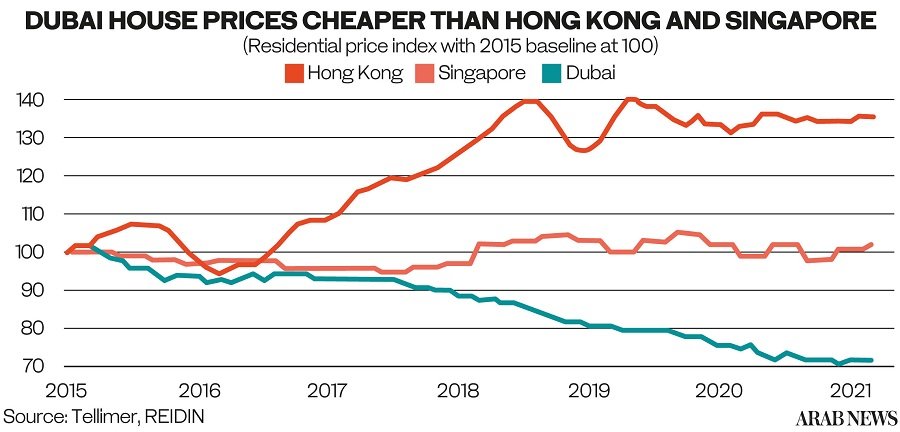

DUBAI: Wealthy Hong Kong expats could be tempted to move to Dubai, lured by cheaper homes, an attractive visa regime and a robust vaccination program, a report claims.

Dubai has liberalized its visa regime, falls under the UAE’s Abraham Accords with Israel, has maintained a globally rare sense of normality during COVID-19 in terms of outdoor activities and open schools, and is efficiently vaccinating its population, Tellimer said in a research note to clients on Tuesday.

The cost of living and cheaper house prices could also prove to be a draw.

Dubai now has a cost of living more than 20 percent below Hong Kong and Singapore — the main driver of which is its cheap property market where prices are down 30 percent since 2015. By comparison, Hong Kong real estate prices rose 35 percent over the same period while they were largely flat in Singapore.

The freeze of assets this month of entrepreneur, media-owner, and pro-democracy supporter, Jimmy Lai, is the latest symbol of the change in Hong Kong since the introduction of the national security law in June 2020, Tellimer said. The move could encourage some of Hong Kong’s wealthy elite to consider moving, it said.

“For rich expatriates who are affluent enough to move for lifestyle and wealth preservation, as much as income generation, Jimmy Lai’s example may serve as another nudge to consider cities like Singapore, a migration underway for some time judging by the anecdotal evidence of private banker relocations and hiring trends,” said report author Hasnain Malik. “Arguably, a more intriguing, and less well-trodden, alternative for rich expats and global emerging market equity investors has emerged in Dubai.”

Dubai recently relaxed its visa system in an effort to attract more people to the emirate which was hit hard by a regional economic slowdown even before the onset of the coronavirus pandemic. However the emirate's battered property sector is now showing signs of stabilization with a recent price rebound at the luxury end of the market.

Source:https://www.khaleejtimes.com

Nature reserves and rural natural areas will constitute 60 per cent of the emirate’s total area, while land used for hotels and tourist activities will increase by 134 per cent

Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, launched the ambitious Dubai 2040 Urban Master Plan on Saturday, March 13.

The sustainable urban development plan envisions green and recreational spaces and areas dedicated to public parks to double in size. Nature reserves and rural natural areas will constitute 60 per cent of the emirate’s total area. Several green corridors will be established to link the service areas, residential areas and workplaces, facilitate the movement of pedestrians, bicycles, and sustainable mobility means across the city, reported state news agency WAM.

The land area used for hotels and tourist activities will increase by 134 per cent, while that used for commercial activities will increase to 168 square kilometres.

Key goals of the plan include: Strengthening citizens’ attachment to older neighborhoods, ensuring the optimal use of our resources, providing better housing options, increasing green spaces, stimulating investment, entrepreneurship and expanding sustainable transport solutions. pic.twitter.com/2biGEmYWjU

It also involves increasing the land area allocated to education and health facilities by 25 per cent, and increasing the length of public beaches by up to 400 per cent in 2040.

The Dubai Urban Master Plan is focused on development and investment in five main urban centers – three existing and two new centers. The existing urban centers include the historical neighbourhoods of Deira and Bur Dubai; the financial heart of the city encompassing Downtown and Business Bay; the hospitality and leisure center encompassing the Dubai Marina and JBR that serves as an international tourism and leisure hub. The two new centers include Expo 2020 Centre, which will featuring affordable housing and will be a focal point for the exhibitions, tourism and logistics sectors; and Dubai Silicon Oasis Centre, which will serve as a science and technology hub.

Some of the key priorities of the Master Plan include improving the efficiency of resource utilization, developing vibrant, healthy and inclusive communities, and doubling green and leisure areas as well as public parks. It will attempt to promote the optimal utilization of the infrastructure by developing vacant urban spaces and encourage mass transit use, walking, cycling and the use of flexible means of transportation, besides developing a planning database to support decision-making.

Dubai 2040 Urban Master Plan is only a step in many to come on the way to achieving H.H. Sheikh Mohammed Bin Rashid’s vision for this city to become the best place to live in the world. That is what Dubai deserves and what its leader wants for it. pic.twitter.com/s3ek0OUdp5

It also seeks to provide sustainable and flexible means of mobility as well a foster greater economic activity and attract foreign investments to new sectors. Other objectives include enhancing environmental sustainability, safeguarding the emirate’s cultural and urban heritage, as well as developing legislation and a planning governance model.

The new Master Plan is the seventh of its kind developed for the emirate since 1960. Between 1960 and 2020, the population of Dubai has multiplied 80 times from 40,000 in 1960 to 3.3 million by the end of 2020, and includes 200 nationalities. The urban and built area of the emirate increased 170-fold from 3.2 square km in the same period.

The plan aims to future-proof the urban development of the emirate. It will therefore focus on utilizing available spaces and concentrating development in existing urban areas. Easily accessible integrated service centers will be established across Dubai. It also seeks to raise the quality of life of the city while increasing population densities around key mass transit stations. The number of Dubai residents is expected to increase from 3.3 million in 2020 to 5.8 million by 2040, while the day-time population is set to increase from 4.5 million in 2020 to 7.8 million in 2040.

The Master Plan will provide for the equitable access to facilities, services and opportunities across the city for all residents.

It defines a hierarchy of communities in the city. The largest of them, the emirate, includes the five main ‘towns’ built around each of the five main urban centers with a population of 1 to 1.5 million, followed by the multi sector with a population of between 300,000 and 400,000; the sector with a population of between 70,000 and 125,000; the district with a population of between 20,000 and 30,000; the community with a population from 6,000 to 12,000 and finally the neighbourhood, with a population between 2,000 and 4,000. Based on these levels, infrastructure and transit systems, energy and government services, and facilities such as hospitals, schools, service centers, and leisure centers will be planned across Dubai.

The Dubai Urban Master Plan 2040 will also integrates the Hatta Development Plan, which has created a framework for the comprehensive development of the area.

Carried out in partnership with the private sector, the Hatta Development Plan will promote tourism within the area.

#Dubai2040 Urban Master Plan integrates the Hatta Development Plan, aiming to develop and raise the profile of Hatta’s natural and tourism attractions, as well as protect its environment in partnership with the private sector. pic.twitter.com/oaR1NE39LO

Sheikh Mohammed said that the new Master Plan will promote “the world’s best quality of life”, and the “highest standards of urban infrastructure and facilities.”

“Drawing inspiration from global best practices and adapting them to local needs and requirements, we have created a development model that offers the best possible quality of life and creates the conditions for sustainable prosperity,” said Sheikh Mohammed.

The very first Master Plan in 1960 involved projects such as opening of Al Maktoum Bridge and of the Dubai International Airport; the second Plan unveiled in 1971 involved the construction of the Jebel Ali Port and Trade Centre; the Third Master Plan launched in 1985 included establishing Emirates Airline and the first Free Zone in Jebel Ali; the Fourth Master Plan showcased in 1995 included the construction of the Dubai International Financial Centre, the Palm Jumeirah and the Mohammed bin Rashid Space Centre; the Fifth Urban Master Plan was launched in 2008 when the population of Dubai was 1.5 million and include the opening of the Dubai Metro, the Al Maktoum Airport in Dubai South and the construction of Terminal 3 at the Dubai International Airport; the sixth plan unveiled in 2012 included the opening of the Dubai Water Canal, the Mohammed Bin Rashid Al Maktoum Solar Park and also involved launching the Museum of the Future project.

Source: "https://gulfbusiness.com/sheikh-mohammed-launches-mega-dubai-2040-urban-development-plan/"

Residential sales prices and rents forecast to be more stable this year, although modest declines expected on average

According to the latest research by one of the leading international real estate services firm, Chestertons, Dubai's residential sector enjoyed a comparatively strong second half of 2020, supported by an increase in completed property sales and continued tenant demand across more-established villa communities.

The findings, revealed in the latest Observer: UAE 2020 Review and 2021 Outlook, showed that while the total value of residential property sales fell by almost 14 per cent over 2020, to Dh55.46 billion from Dh64.34 billion in 2019, completed property sales gained pace over the second half of last year, reaching Dh21.67 billion, a 35.5 per cent increase from Dh15.99 billion seen in the second half of 2019.

Villa sales prices recorded a comparatively moderate 3.6 per cent decline in 2020, with the overall annual fall eased by a robust final quarter. Apartment sales price declines were more pronounced, falling 9.5 per cent year-on-year, with continued unit completions continuing to place downward pressure on values. In the rental sector, villa rents witnessed an annual fall of 5.3 per cent, while apartment rents fell by 12.4 per cent.

Chris Hobden, Head of Strategic Consultancy, Chestertons MENA, said, "Dubai's residential sector enjoyed a comparatively strong fourth quarter, with sales activity continuing to gain pace since mid-last last year. While residential rents continued to see steady falls, the pace of price declines eased in the final months of 2020, with the market-wide average bolstered by several villa communities seeing minor uplifts in achieved prices.

"Overall, we expect to see modest declines in both average prices and rents this year, with ongoing unit completions likely to hamper performance. Price movements will increasingly vary by location and property type though, and we expect healthy demand for completed villas, across more-established residential areas, to continue into 2021.

On an annual basis, villas at Palm Jumeirah and The Meadows/The Springs saw the lowest price falls, with prices declining by just 2.1 per cent and 2.7 per cent, respectively. Values across Jumeirah Park and The Lakes saw the highest annual drop, falling by 5.2 per cent and 4.9 per cent respectively year-on-year.

In contrast, several locations saw modest uplifts in average villa prices over Q4, primarily driven by strong resale demand. Average villa prices across Jumeirah Park increased from Dh720 per sqft in Q3 to Dh725 per sqft in Q4, with average prices in Palm Jumeirah rising from Dh1,860 per sqft to Dh1,870 per sqft last quarter.

The largest annual price declines were witnessed in Discovery Gardens, with prices falling by 13.5 per cent annually to Dh498 per sqft, from Dh576 per sqft in Q4 2019.

Dubai Sports City and Motor City also saw comparatively sharp declines year-on-year, falling by 13.3 per cent and 12.8 per cent respectively. Prices averaged Dh600 per sqft in Dubai Sports City, with Motor City prices decreasing to Dh510 per sqft.

Business Bay and Dubai Marina witnessed more moderate declines over 2020, with prices falling by just 3.7 per cent to Dh973 per sqft, and 4.9 per cent to Dh980 per sqft, respectively.

In the villa rental sector, rates fell by 5.3 per cent on an annual basis. The Springs, Al Furjan, and The Meadows saw the steepest yearly declines, with rents decreasing by 10.1 per cent, 7.5 per cent and 6.9 per cent, respectively. The Lakes, Victory Heights and Arabian Ranches all saw annual declines of above 5 per cent, with a four-bedroom unit in each community averaging Dh212,000, Dh142,000 and Dh155,000 per annum, respectively.

While all areas saw annual declines, Q4 witnessed relative stability in average villa rents, with the majority of locations seeing rates hold steady, and a minority seeing modest improvements, leading to an average quarter-on-quarter drop of just 0.2 per cent. Palm Jumeirah, Jumeirah Golf Estates and Arabian Ranches all recorded slight uplifts in average rents over Q4. Palm Jumeirah saw rents rise by 0.9 per cent, with Jumeirah Golf Estates and Arabian Ranches seeing upticks of 0.4 per cent, respectively, quarter-on-quarter.

"With work-from-home policies continuing across parts of the private sector, and tenant demand for larger residential accommodation likely to remain strong, we expect villa rents to continue to outperform the wider residential average over the coming year," said Hobden.

For apartments, downward pressure on rental rates continued due to the economic impact of Covid-19, causing a year-on-year fall of 12.4 per cent. The highest annual declines were seen in The Views and Discovery Gardens, at 16.3 per cent and 16.2 per cent respectively, with two-bedroom units in The Views averaging Dh100,000 over Q4. In Dubai Motor City rates fell by 15.9 per cent, with three-bedroom apartments standing at Dh98,500, down from an average of Dh105,000 per annum in Q4 2019.

Studio units saw the sharpest fall over 2020, at 14.8 per cent, followed by one and two-bedroom units, which fell by averages of 13.2 per cent and 11.8 per cent, respectively. Three-bedroom units declined annually by 9.2 per cent.

Source: "https://www.khaleejtimes.com/business-and-technology-review/real-estate-on-the-rise"