New UAE Central Bank report says economy will be buoyed by increasing fiscal spending, a pick-up in credit and employment and Expo 2020 Dubai

UAE economic growth is forecast to recover fully from the impact of the global coronavirus pandemic in 2022, with real gross domestic product (GDP) seen rising by 3.5 percent.

According to new figures released by the Central Bank of the UAE on Thursday, real GDP will rebound to positive growth of 2.5 percent in 2021.

It said non-oil GDP will grow by 3.6 percent while the country's oil economy is likely to remain flat based on the OPEC+ production schedule and announcements.

In its report, the central bank said real non-oil GDP growth is expected to be driven by increasing fiscal spending, a pick-up in credit and employment, relative stabilization of the real estate market and Expo 2020 Dubai, which is set to start on October 1.

It added that in 2022, a full recovery is expected, with overall real GDP increasing by 3.5 percent, with non-oil real GDP rising by 3.9 percent.

In January, the UAE approved amendments to its nationality laws to attract more foreign talent to contribute to the country's "development journey".

It was the latest in a series of initiatives recently announced by the UAE as its economy looks to rebound from the impact of the global coronavirus pandemic.

The UAE abolished the need for companies to have Emirati shareholders late last year, in a major shake-up of foreign ownership laws aimed at attracting investment into an economy reeling from the coronavirus and a decline in oil prices.

In September, Dubai launched a retirement programme for resident expatriates and foreigners over the age of 55.

Retire in Dubai, the first of its kind in the region, is being spearheaded by Dubai Tourism in collaboration with the General Directorate of Residency and Foreigners Affairs.

Eligible applicants will be provided a retirement visa, renewable every five years. The retiree can choose between one of three financial requirements for eligibility: earning a monthly income of AED20,000 ($5,500); having savings of AED1 million ($275,000); or owning a property in Dubai worth AED2 million ($550,000)

In its initial phase, the programme will focus on UAE residents working in Dubai who have reached retirement age.

Dubai has also recently launched the Virtual Company Licence, which allows global businesses to access a regulated e-commerce platform populated by Dubai-based companies, while also exploring new markets and investment opportunities digitally.

The initiative, which allows investors worldwide to do business in Dubai digitally without having to live in the emirate, is expected to attract more than 100,000 companies.

Source: "https://www.arabianbusiness.com/politics-economics/460522-uae-economy-forecast-to-fully-recover-in-2022-with-35-gdp-growth"

Positive economic indicators, laying foundations for future, bode well for nation's GDP

In December 2020, the UAE government received an Aa2 rating in creditworthiness — which is the highest sovereign rating in the region — with a stable outlook for the national economy by Moody’s.

“This is another testament to the success of the country’s financial and economic vision and policies, and the strength and stability of its economic, financial and credit sectors,” the report, which highlights the advancements of the nations on several fronts, said. In November 2020, Fitch Ratings awarded the UAE’s federal government with an AA- rating with a stable outlook.

In its report on the UAE’s sovereign credit profile, Moody’s pointed out that the country’s credit strength is supported by a high GDP per capita, as well as by its internal stability and strong and broad international relations.

The Central Bank of the UAE expected robust GDP growth in 2021, as the government is continuing its efforts to diversify the economy, boost spending on infrastructure and encourage private investment, as a gauge for growth and private sector employment.

The World Bank has predicted that the $414 billion UAE economy would grow by 2.4 per cent in 2022, after a contraction of 6.3 per cent in 2020 and a one per cent rise projected for 2021.

The Washington-based Institute of International Finance expects modest economic recovery for the UAE in 2021 with real GDP growing by 2.3 per cent, following a contraction of 5.7 per cent in 2020. It predicted three per cent growth for the next year, 3.4 per cent for 2023 and 3.5 per cent a year later.

The UAE central bank said despite the extraordinary global conditions caused by the pandemic, there is optimism due to some early signs of a rise in international trade, such as the gradual lifting of movement restrictions, the issuance of bonds and sukuk, the resumption of activities in capital markets, steady negative inflation rates, the return of spending levels to normalcy, the rise of the national employment rate to 1.7 per cent per month in December, and the monthly rise of real estate sale prices.

Several positive signs emerged in the UAE’s oil and gas sector in 2020, most notably with the success of Abu Dhabi National Oil Company (Adnoc). Adnoc’s major achievements in 2020 included the discovery of a new natural gas field in an area between Seih Al Sedirah in Abu Dhabi and Jebel Ali in Dubai, containing massive stocks totalling some 80 trillion cubic metres.

The Supreme Petroleum Council also announced the discovery of 22 billion stock tank barrels (STBs) of non-conventional and recoverable crude oil in Abu Dhabi. IT also announced the addition of two billion STB to the country’s conventional oil reserves, increasing the UAE’s conventional oil reserves base to 107 billion STBs of recoverable oil.

Adnoc attracted foreign direct investments worth Dh62 billion to the UAE, with total FDIs attracted by the oil major since 2016 are valued at Dh237 billion.

The total value of the UAE’s non-oil foreign trade during the first nine months of 2020 amounted to Dh1.03 trillion, according to the National Competitiveness and Statistics Centre’s figures. The country’s trade balance registered an excess for the first time last year, posting 15 per cent in September 2020, as well as a 5.6 per cent growth in third-quarter exports.

In real estate, the value of registered transactions in 2020 amounted to nearly Dh275 billion, including land, residential, commercial and industrial unit sales, as well as mortgages and grants. E-commerce witnessed a substantial rise in the UAE during the coronavirus crisis, with the value of digital transactions in 2020 amounting to $18.50 billion.

In the aviation sector, Dubai International Airport made significant positive steps towards recovery after a challenging year, handling 25.9 million passengers in 2020.

Etihad Airways announced that it transported 4.2 million passengers last year, recording proceeds of $1.2 billion in 2020. It also performed strongly in terms of shipping, with a 66 per cent increase in proceeds, surging from $700 million in 2019 to $1.2 billion in 2020.

— This email address is being protected from spambots. You need JavaScript enabled to view it.

Source: "https://www.khaleejtimes.com/business/economy/uae-economy-on-track-for-early-recovery"

While the downward trajectory in the real estate market for the short term is unavoidable due to strained economic and market conditions, the medium and long term outlook for the UAE is more encouraging

While the downward trajectory in the real estate market for the short term is unavoidable due to strained economic and market conditions, the medium and long term outlook for the UAE is more encouraging, fuelled by recovering oil prices, forecasted GDP growth, a proactive government response and clear focus on economic progress and sustainability, Aengaar said.

Covid-19 created an environment of uncertainty, which resulted in the need for pre-existing/emerging market trends to be accelerated, some of which are merely circumstantial while others are here to stay for the long run.

“Flexible and home working, use of advanced and smart technologies such as AI, automation, contactless technology, need for larger units with outdoor space and increased storage space and preference for lower density developments are some of the trends that will be taken over in 2021 and beyond,” said Aengaar.

According to Asteco’s Q4 2020 UAE Real Estate Report, the real estate sector has shown an unexpected level of resilience in the face of serious challenges created by the pandemic. However, the supply-demand imbalance is likely to worsen over the course of 2021, similar to last year.

In Abu Dhabi, approximately 15,000 residential units are anticipated for completion in 2021. The majority of the upcoming supply is located within the following Investment Zones: Reem Island comprising approximately 1,850 units, Al Raha Beach with 4,000 units, Yas Island with 2,400 units and Saadiyat Island with 800 units.

Similar to 2020, Al Ain will see a limited amount of new supply in 2021.

In Dubai, 41,500 new residential units and 1.5 million sq.ft. of office space are expected for handover in 2021, a figure that could possibly increase if currently stalled/on hold projects resume activity.

Sales prices and rental rates remained in contraction in 2020, primarily driven by the pre-existing supply-demand imbalance broadly in line with previous years and does not seem to have changed with the manifestation of Covid-19.

“At the end of 2020, an increase in Villa Sales prices and Rental rates for certain developments was witnessed, which was attributed to changing work/place and work-life habits.”

The report noted that the longer-term trend towards remote working will also see a need for larger Residential dwellings and short term/serviced Apartments with more flexible Leasing and payment plans.

During 2020, the leasing sector benefited from the implementation of direct debit and credit checks, while the Sales market profited from reduced LTV (loan-to-value) ratios and lower interest rates for Expatriates and Emiratis alike.

— This email address is being protected from spambots. You need JavaScript enabled to view it.

Source: ""https://www.khaleejtimes.com/business/real-estate/stimulus-vaccine-to-fuel-uae-real-estate-resilience

UAE announces citizenship for investors, medical doctors, skilled professionals, scientists and talented people

he amendment to the law also includes the option to hold dual citizenship

Dubai - In a historic move, the UAE on Saturday announced major changes to the citizenship law, to allow for the naturalisation of foreign investors, doctors, scientists, artists and talented people and their families.

The decision to give people with exceptional talents and their families the Emirati citizenship aims to embrace them as members of part of the UAE society, ensure the social stability of these people in the country and boost the overall national development process.

The changes, taken upon the directives of President His Highness Sheikh Khalifa Bin Zayed Al Nahyan, were approved by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai, on Saturday.

The decision specified the categories of the people who can be granted the citizenship, under certain conditions. In addition to granting the citizenship to the families- the spouse and children of this specialised and skilled segment, the law allows for them to also keep their current citizenship, which is a major change to the previous rule that doesn’t allow for dual citizenship.

Requirements

The law detailed the terms and conditions upon which the citizenship can be granted:

Investors: Must own a property in the UAE

Medical doctors and skilled professionals: Must be specialised in a unique scientific field that is needed by the UAE, have contributed to studies and research that have scientific value in their field, have 10 years of experience in that field in addition to a membership in a prestigious professional organisation in his field.

Scientists: Must be an active researcher in their field at a university, a research institute or the private sector, have 10 years of experience in that field, have scientific contributions- such as having won a prestigious scientific award, or having secured a significant funding for their research for 10 years, in addition to a recommendation letter from a credited scientific institute in the UAE.

Talented people:

Inventors: they must have had at least one patent certified by the UAE Ministry of Economy or any accredited relevant international body, which has a real value to the UAE economy, in addition to a recommendation letter from the UAE Ministry of Economy.

Intellectuals and artists: they must be pioneers in culture, arts and other talents with at least one international award in those talents in addition to a recommendation letter from the UAE relevant bodies.

Conditions

The new law stipulates the terms and conditions of the granting of citizenship to those talented segments, such as the oath and swearing in allegiance to the UAE, a pledge to uphold and respect the laws of the country, informing the relevant authority if they get a new citizenship or lost one.

Meanwhile, the changes also specified the rights of those who are granted the UAE citizenship under the new law, such as the right to establish and own companies in the UAE, buy and own land and real estate property in the country, in addition to any other right extend to them by the federal bodies, with the approval of the Cabinet, or by local government bodies.

The decision also said that the UAE citizenship can be stripped from those categories in such cases as the violation of the legal commitment or losing at least one of the conditions upon which a person was granted the citizenship.

Mechanism

The new law specified the citizenship process, saying that those qualified for the citizenship would be nominated through the Emirates’ rulers court, the courts of the crown princes, the executive council in an emirate or the cabinet.

Saturday’s decision, the first major change to the UAE nationality law No.17 of 1972 on Nationality and Passports, represents a milestone in the Arab world, which usually restrict the naturalisation process to a very limited cases and mostly bans dual citizenship. The UAE has taken several steps recently to ensure the social stability of those with long time residency in the country and those who contribute to the wellbeing and development of the society through the introduction in 2019 of the permanent residency scheme, which allowed for granting 5 and 10 year ‘Golden Visas’ to certain categories of residents. Thousands of people have been given the Gold Visa in the past two years, including investors, medical professionals, engineers, scientists and specialised talents.

The new changes put the UAE on par with many developed nations that appreciate the talents of expatriates by awarding them the citizenship, ensuring in the process their social stability and secure a future for them and their families in the country.

Source:"https://gulfnews.com/uae/government/uae-announces-citizenship-for-investors-medical-doctors-skilled-professionals-scientists-and-talented-people-1.1611990919313"

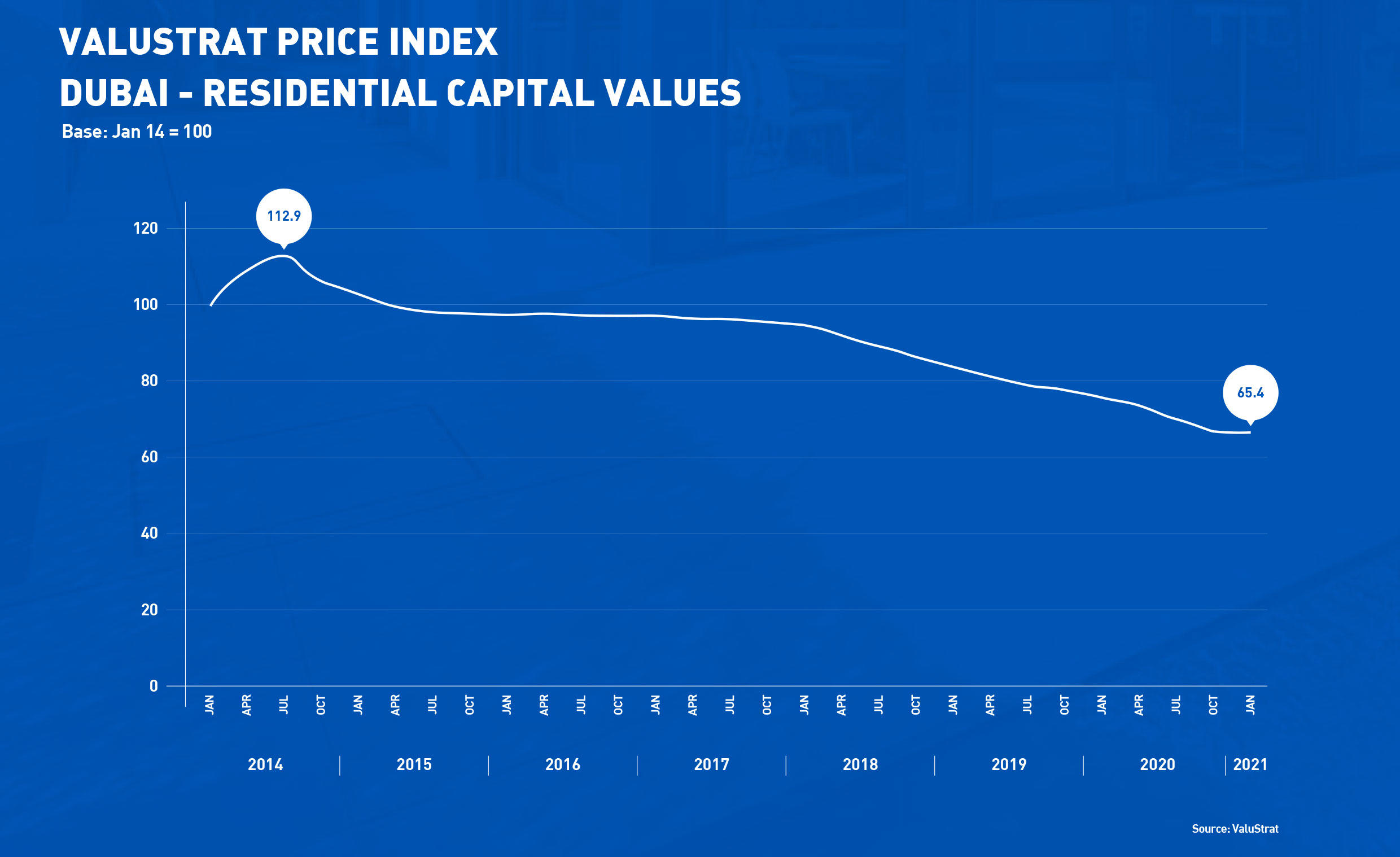

ValuStrat says the long-running downward trend in Dubai real estate values came to a 'standstill' last month

Residential real estate prices in Dubai registered a marginal 0.1 percent increase in values in January compared to the previous month, an early sign of growth for the first time in five years, according to consultants ValuStrat.

Its new report said that property prices in Dubai approached stabilization in January as the long-running downward trend came to a "standstill".

Annually, ValuStrat said its valuation-based index was 12.3 percent lower than last year but stability and marginal improvements in capital values were observed in all established villa communities as well as nearly half of free-hold apartment areas in Dubai.

January registered a 29.8 percent monthly drop in home sales transaction volumes, as existing ready-to-move-in properties saw a decline of 24.7 percent, and off-plan sales shrunk 39.2 percent when compared to the previous month.

ValuStrat said some locations monitored by the VPI saw capital values decline around 1% monthly - examples of which were apartments in Dubai Sports City, Dubai Production City and Jumeirah Village Circle.

"However, given the high demand due to record low prices per square foot, villa capital values demonstrated higher resilience when compared to apartments. All villa freehold locations saw capital values stabilise this month, and, in a few areas, continued to register monthly increases," ValuStrat added.

Examples include Arabian Ranches, The Meadows, The Lakes, Emirates Hills and Jumeirah Islands.

ValuStrat also said that 69 percent of January’s cash-based sales transactions volume was towards ready homes as off-plan sales have slowed due to limited project launches.

Properties developed by Emaar, Nakheel, Damac, Binghatti and Nshama topped the sales charts overall while the top off-plan locations transacted during January were in Jumeirah Village, MBR City, Al Jaddaf, Sobha Hartland and Business Bay. The most transacted ready homes were located in Business Bay, Dubai Marina, Town Square, Dubai Silicon Oasis and Palm Jumeirah.

Source: "https://www.arabianbusiness.com/property/458488-dubai-property-prices-rise-in-january-for-first-time-in-five-years"

A total of $790 million was spent on real estate transactions in Dubai in the week ending November 5.The Department of Land and Property in Dubai recorded a total of 1,241 deals which included 44 plots sold for a total of $48.08 million and 854 apartments and villas sold for $405 million. The top two transactions were land in Al Merkadh and in Al Barsha South Forth which fetched which $4.45 million and $3.43 million

The weekly statistics come on the back of a positive September and third quarter in Dubai’s property sector. According to the department, there was a 55% increase in sales volumes for Q3 and a 65% increase in total value compared to the previous quarter.

© 2020 funds global mena

Source: "http://www.fundsglobalmena.com/news/dubai-sees-boom-in-property-deals"

The emirate’s real estate sector has witnessed signs of a rebound in the wake of easing Covid-19 restrictions

What a year this has been for real estate in Dubai. Despite the crisis and the roller coaster ride we saw in transaction flows and buyer sentiment, we are currently in a very interesting

place.

Prices are now stabilising in prime areas where supply is low, and in some places, rates are also rising. We are starting to see multiple offers for properties in these areas as well.

So, how did we get here?

Going back to the start of the year, in January and February of 2020, Dubai’s property market saw month-on-month increases in real estate transactions following similar trends from H2 2019.

During these two months, the enthusiasm for Expo 2020 was still strong, and this was seen in the transaction volumes. This trend, of course, came ahead of concerns of Covid-19, which started to heighten in March.

There was a 12 per cent year-on-year rise in overall transactions in January 2020, with the figures growing 33 per cent year-on-year in February, with an incredible 76 per cent rise in off-plan transactions.

Individual investors were looking at this period as an opportunity to invest in a city that was going to be hosting the biggest show on earth, Expo 2020, and this interest was also backed up by the enormous amount of surplus supply the market still had from the previous year.

Looking more broadly at the first quarter of the year, Dubai real estate sales transactions grew by 9.74 per cent when compared to the same time period in Q1 2019. In fact, Q1 2020 had the highest number of transactions since Q1 2017, with the market cruising towards what looked like would be a record breaking year.

But when the pandemic came to the forefront in March, it was obvious that we would see a slowdown in transactions. Due to the UAE government’s proactive policies and swift and innovative efforts, we made it through this tough period quicker than most. Innovative efforts from the authorities also helped the real estate market to start transacting again.

One such decision from the Dubai Land Department was the introduction of online property transfers. Once the registration trustee offices came back to work with 30 per cent of their workforce, those looking to close a deal could book an appointment a day in advance and email the documents. That way the interaction on premises was reduced to a minimum. The online procedure implemented during the lockdown remain in place, and property registrations now can also be completely done online.

Dubai was in full lockdown in April, partially in May and didn’t start opening fully until June. Hence, the entire second quarter was affected by Covid-19. Overall, Dubai saw 5,552 sales transactions in Q2 2020 worth Dhs10.86bn, down 38.7 per cent (9,062 transactions) and 42 per cent (Dhs18.78bn) respectively compared to the same period last year.

As the average property sales cycle is 45-60 days, we saw the biggest impact of the lockdown on the sales transactions in the second half of May, with volumes dropping to their lowest levels at the end of the month. While the secondary market saw 40 per cent of the transactions in Q2, off-plan accounted for 60 per cent of the transactions.

However, that trend began to change in June, when, for the first time since the crisis began, off-plan sales transactions volumes dropped below those in the secondary market. Real estate sales transactions also grew in June, with an average of around 570 properties sold in Dubai every seven days. Sales and rental enquiries were also up compared to last year for both apartments and villas/townhouses, with the highest increase in enquiries for villas/townhouses.

So why would people look to buy property right after the lockdown and during a pandemic?

The answers – pent-up demand coupled with attractive prices and lower down-payment and funds required – a move that was implemented by the UAE central bank during the lockdown.

A strong June laid the foundation for a faster recovery and we started to see patterns of a V-shaped recovery, characterised by a rapid rise following a sharp decline. We slowly started heading back to the transaction levels of February and early March 2020. August typically has been a slow month for Dubai real estate when compared to the rest of the year, but not in 2020.

According to Data Finder, the data platform under the Property Finder group, August 2020 saw a rise of 11.3 per cent in real estate transactions compared to August 2019. In previous years, the summer months were typically slower for real estate transactions in Dubai because of the holidays.

This year, due to the Covid-19 situation, many residents chose not to travel. This, coupled with pent-up demand and attractive pricing drove transactions higher. Looking only at the secondary market, August 2020 had 22.4 per cent more transactions than August 2019.

New trends

The softening of Covid-19 restrictions by the UAE government has positively impacted market sentiment across the real estate sector. Real estate portals Property Finder and Mortgage

Finder saw an immediate increase in consumer enquiries and searches as movement restrictions were revised.

We have started to see signs of the market returning to a new normal. In addition, a new trend emerged which we didn’t see during the lockdown period – rental enquiries for villas in Dubai went up. Another trend we saw at the start of the crisis was an increase in searches for villas/townhouses with outside space such as gardens, balconies and pools. This was a clear indication that people are valuing personal, outside space in their homes.

The key new trends that have emerged are as follows:

• Significant increase in short-term leads, especially in Dubai

• The percentage of searches for “pool” and “garden” have increased

• People are increasingly searching for bigger houses

• In rentals, the high price category units are the least affected

• Payment terms for rentals are significantly more important now. Landlords are accepting a higher number of cheques to ease the financial load on the tenants

• The percentage of searches for warehouses in commercial real estate is increasing

During the lockdown, search and demand data on Property Finder showed that people started looking for bigger properties, shifting from the traditional small family apartments to

villa/townhouses. This trend has grown significantly since the crisis started and continues to have an effect on the market.

Since the start of the pandemic, the ratio of sales transactions for one-bedroom units has fallen by over 10 per cent and for studios by more than 34 per cent. The ratio of transactions for three-, four- and five-bedroom units has increased by 9 per cent, 20 per cent and 15 per cent respectively.

When looking at the split between apartments and villas/townhouses, the volume of villas/townhouses sales transactions to the percentage of apartments increased gradually from a 12/88 split to now a 21/79 split.

In July, a total of 494 sales transactions were recorded for ready villas/townhouses, as consumers were looking for ready units to move into. This marks the highest number of villas/townhouses sold in a single month since transaction data was made available in 2008.

Talking off-plan

Another interesting trend that changed during the crisis was the split of off-plan versus secondary market transactions.

Over the last two years, the split between off-plan and secondary market always hovered in the 50/50 range. Once the crisis started, off-plan transactions started to increase and the split grew to 70 per cent by May. However, once the lockdown eased, the trend shifted and there was an increase in secondary market transactions. The split also reversed, with off-plan now only accounting for 30 per cent of all sales transactions.

Market movement

The market started strong at the beginning of the year because of the expectations surrounding Expo 2020 and fell drastically between March and April due to the Covid-19 impact.

The market reached its lowest point in May 2020 and once the lockdown was lifted, it began its recovery. Now, despite claims of a second coronavirus wave, the market appears to be fully equipped to handle the crisis. From what the data shows us, the market started stabilising in June and since then it has gradually improved. Listings are increasing, consumers are sending more enquiries and property agents are closing more deals – some even virtually – and the number of consumers looking for mortgage pre-approvals has increased by over 30 per cent.

We are seeing consistent growth, even if it is fractional. As we slowly return to our ‘new normal’ and the Dubai real estate market becomes more dynamic and adaptable to change, some of the new trends that have emerged during the crisis look like they are here to stay.

Lynnette Abad is the director of research and data at Property Finder

Source "https://gulfbusiness.com/building-back-is-dubais-real-estate-market-rising-again/"

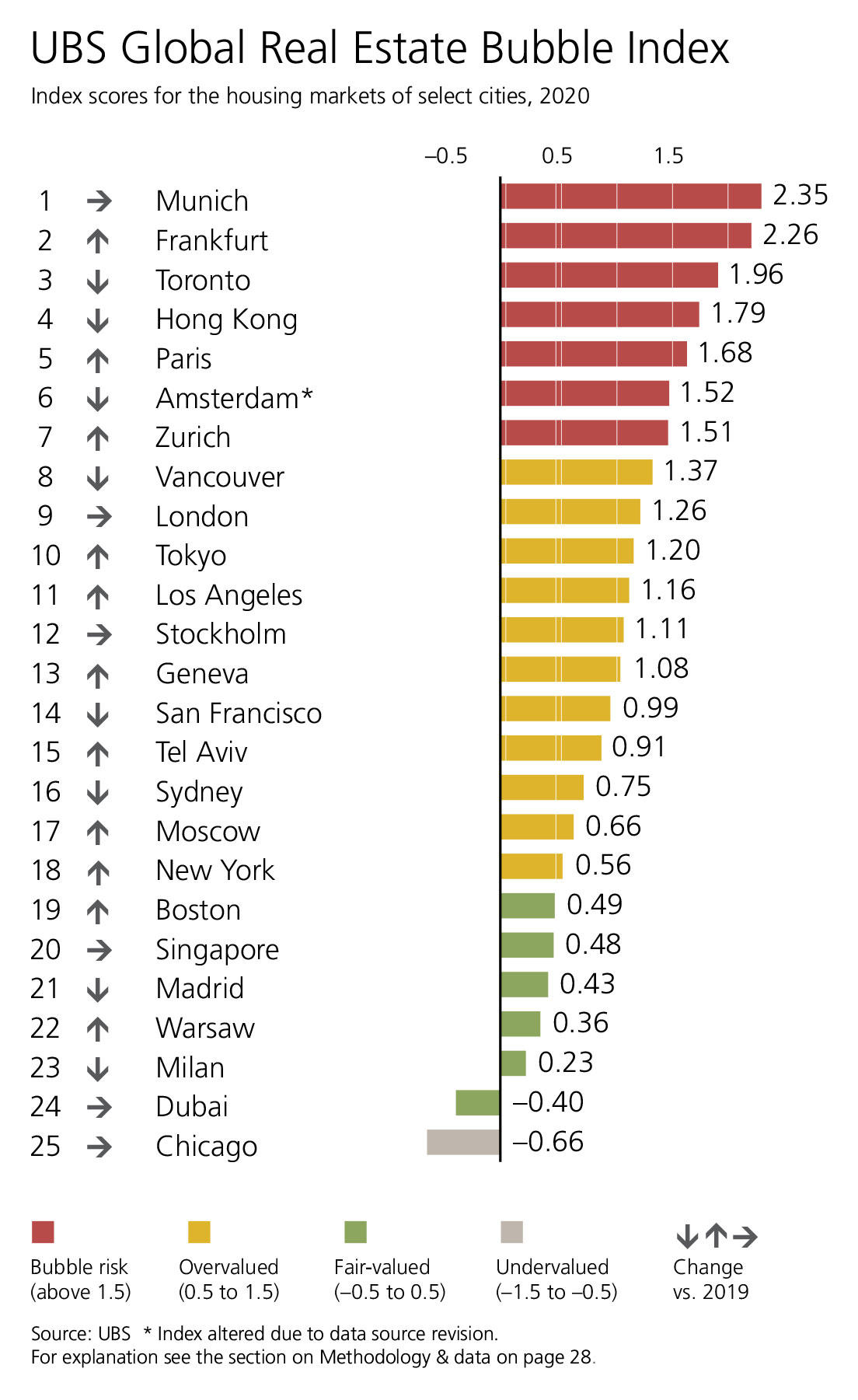

New UBS research shows Dubai real estate market is fairly valued compared to global peers after years of price declines

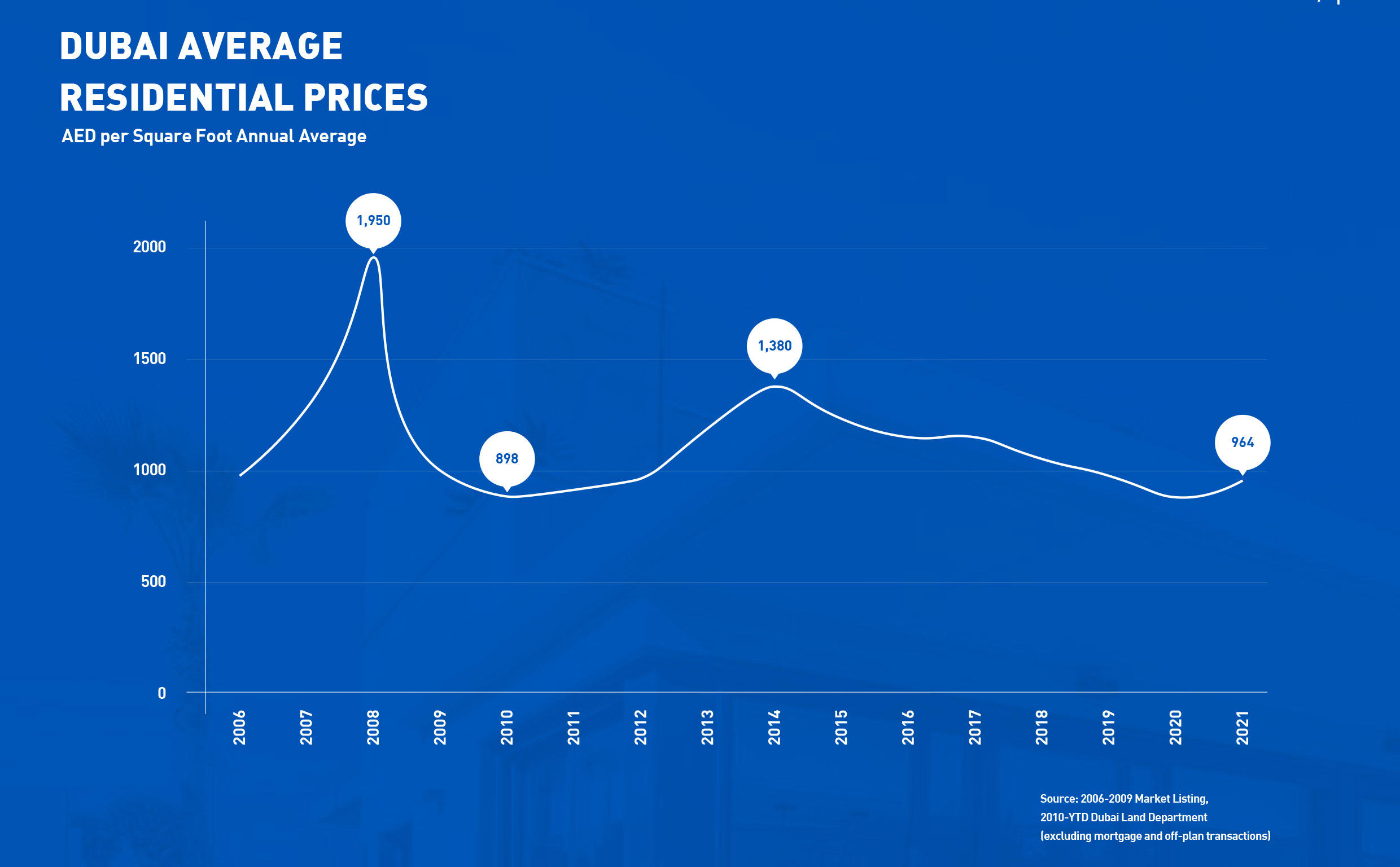

Dubai's real estate market remains fairly priced compared to other major cities in the world after seeing six years of falling values after reaching a peak in 2014, according to new research.

The UBS Global Real Estate Bubble Index 2020, a yearly study by UBS Global Wealth Management's Chief Investment Office, indicates bubble risk or a significant overvaluation of housing markets in half of all evaluated cities around the world.

The Eurozone stands out as the region with the most overheated housing markets. Munich and Frankfurt top the ranking, with Paris and Amsterdam closely following.

By comparison, prices in Dubai are fairly valued, UBS said, adding that the market is likely to see a rebound in the mid- to longer-term.

Ali Janoudi, head of Middle East and Africa at UBS Global Wealth Management, said: “Dubai's property market has reached a cyclical low. Since the last peak in 2014, prices have fallen. What we’re seeing is that positive price effects of high population growth and easier mortgage regulations are being offset by ongoing high supply growth and weaker oil prices.

"However, Dubai’s real estate market is cyclical and we believe that mid-to longer term, the housing market will recover as the city remains a very attractive hub for financial services and many other industries.”

Despite the coronavirus pandemic, housing markets have remained resilient in the first half of 2020, according to UBS.

The study cites three main reasons for this outcome.

First, home prices are a backward-looking economic indicator and are only able to reflect an economic downturn with a certain delay.

Third, governments supported homeowners in many cities during the lockdown periods. Housing subsidies were increased, taxes lowered, and foreclosure procedures suspended.

Mark Haefele, chief investment officer at UBS Global Wealth Management, said: “It is uncertain to what extent higher unemployment and the gloomy outlook for household incomes will affect home prices. However, it’s clear that the acceleration over the past four quarters is not sustainable in the short run.

"Rents have been falling already in most cities, indicating that a correction phase will likely emerge when subsidies fade out and pressure on incomes increase.”

High market valuations and an uncertain short-term outlook are bringing the longer-term trajectory of city housing into focus.

On the one hand, the key appreciation drivers of urban housing – superior employment opportunities and amenities, low financing costs, and limited supply growth – remain in place. On the other hand, the pandemic seems to be accelerating a shift of population growth from cities to the wider metropolitan areas.

On average, inflation-adjusted price increases have accelerated in the last four quarters. In many European metropolitan areas, prices soared by more than 5 percent, with Munich, Frankfurt, and Warsaw leading the way. Price growth in the Asian and American cities, with the exception of Sydney, remained in a low-to-mid single-digit range.

Dubai, Madrid, San Francisco and Hong Kong are the only cities that saw a decline in prices. This is the lowest number of cities experiencing negative price growth since 2006.

Claudio Saputelli, head of Real Estate at UBS Global Wealth Management’s Chief Investment Office, said: “The rise of the home office calls into question the need to live close to city centres. Pressure on household incomes cause many people to move to more affordable suburban areas. Moreover, already debt-ridden or economically weaker cities will have to respond to this economic crisis with tax increases or public spending cuts, neither of which bode well for property prices. Taken together, these factors amplify some longer-term uncertainties surrounding urban housing demand.”

Separately, a research note from Data Finder, the insights and data platform under the Property Finder group, said on Thursday that September has reinforced that the Dubai real estate market is in a full V-shaped recovery.

Its data showed that September had 3,853 property sales transactions which was 56.56 percent higher than the month of August and 59.68 percent higher than the month of July.

The total value of the transactions was AED8.93 billion which is 88.38 percent higher than the previous month and 36.04 percent higher than September 2019.

Lynnette Abad, director of Research & Data at Property Finder, said: “There has been quite an array of interesting dynamics in the Dubai real estate market these past few months. We have low supply in prime areas where demand is high which has caused multiple buyers and bids on properties.

"Sale prices in prime areas have risen while rents have consistently stayed the same. Our broker clients are having all time record breaking months. Needless to say, pent up demand, best ever mortgage rates and lower down payments have been the perfect combination to stimulate the Dubai real estate market.”

According to the new figures, Q3 had a total of 8,727 property sales transactions which is 55.76 percent higher than Q2 with the value of deals topping AED18.3 billion.

The top areas for overall sales transactions in Dubai during September were Tilal al Ghaf, Business Bay, Jumeirah Village Circle, Dubai Marina and Mohammed bin Rashid City.

source "https://www.arabianbusiness.com/property/452491-how-dubai-property-prices-compare-globally-for-investor-risk"